Earnings Growth in 2019 Fueled by Strong Mobile Results and Full-Year TWG Contributions

Company Expects to Grow 2020 Net Operating Earnings Per Share, Ex. Catastrophes, by 10 to 14 Percent

|

Key Highlights for Full-Year 2019

|

Note: References to net income (loss) refer to net income (loss) attributable to common stockholders. Comparisons in the financial highlights relate to last year’s prior period unless otherwise noted. Full-year 2019 earnings included $18.0 million of disclosed items, comprised of a $9.9 million charge related to Global Preneed in the third quarter and $8.1 million of severance related to the company’s multi-year IT transformation in the fourth quarter.

NEW YORK, Feb. 11, 2020 — Assurant, Inc. (NYSE: AIZ), a leading global provider of lifestyle and housing solutions that support, protect and connect major consumer purchases, today reported results for the fourth quarter and full-year ended December 31, 2019.

“We are pleased with our overall performance in 2019, delivering earnings growth in-line with our expectations. Importantly, we also strengthened our partnerships with leading brands and invested in capabilities to sustain business growth and achieve a more diversified mix of earnings in 2020,” said Assurant President and CEO Alan Colberg.

Colberg added, “We believe our unique position supporting consumers’ connected lifestyles across mobile, home and auto will drive continued outperformance long-term.”

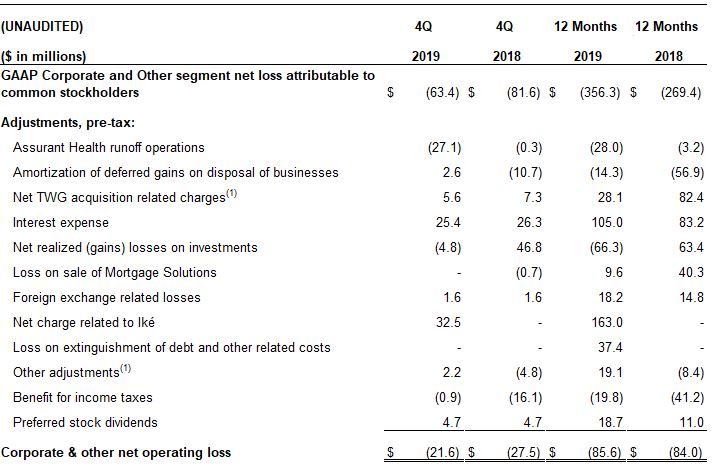

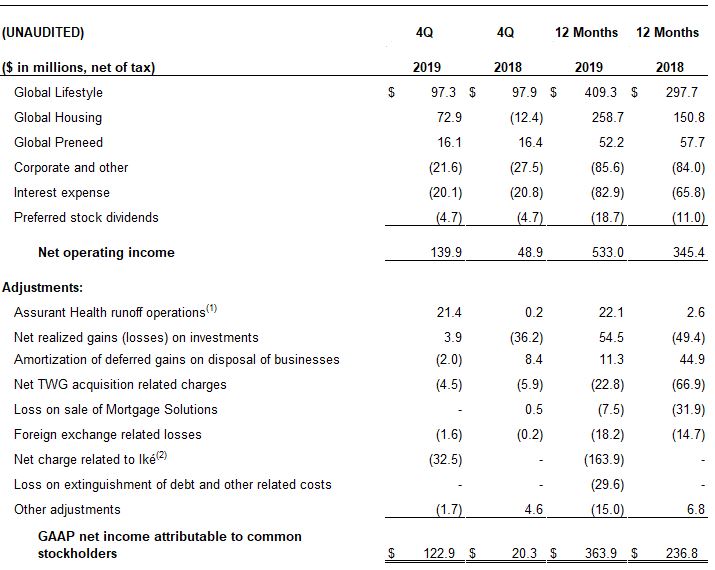

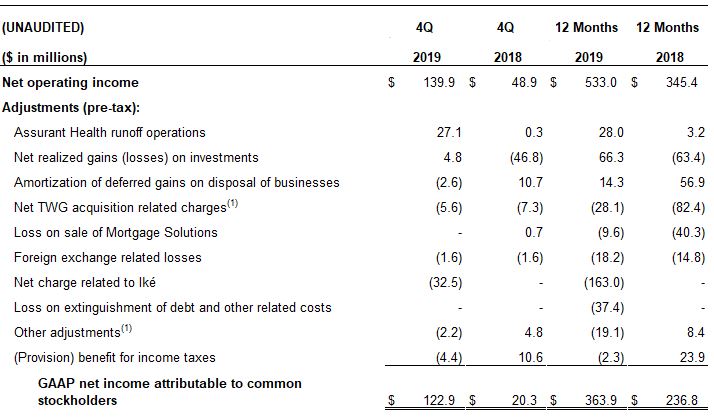

Reconciliation of Net Operating Income to GAAP Net Income (Loss) Attributable to Common Stockholders1

Note: 2018 net operating income includes The Warranty Group (TWG) earnings beginning June 1, 2018 and mortgage solutions results prior to the sale on August 1, 2018. A full reconciliation of net operating income to GAAP net income attributable to common stockholders can be found on Page 10. Additional details about components of net TWG acquisitions related charges, the components of Other adjustments and other key financial metrics are included in the Financial Supplement located on Assurant’s Investor Relations website http://ir.assurant.com/investor/default.aspx

(1) Includes $21.1 million after-tax income related to the reduction of the valuation allowance on the company’s Patient Protection and Affordable Health Care Act 2010 (ACA) risk corridor program receivables. Please refer to the Financial Supplement for additional information.

(2) On January 29, 2020, the company signed an agreement to sell its interests in Iké, subject to regulatory approval. Fourth quarter 2019 results included a $32.5 million after-tax charge associated with the anticipated sale. Full-year 2019 results included after-tax losses of $163.9 million, including previous impairment losses and other charges (of which $38.4 million related to cumulative foreign currency losses recorded in other comprehensive income). At closing, a $54 million net cash outflow is expected, plus customary transaction costs. This represents the difference between the balance owed on the put/call and the agreed sale price. The cash outflow may increase up to an additional $40 million in the event we provide seller financing to the management shareholders at closing.

Fourth Quarter 2019 Consolidated Results

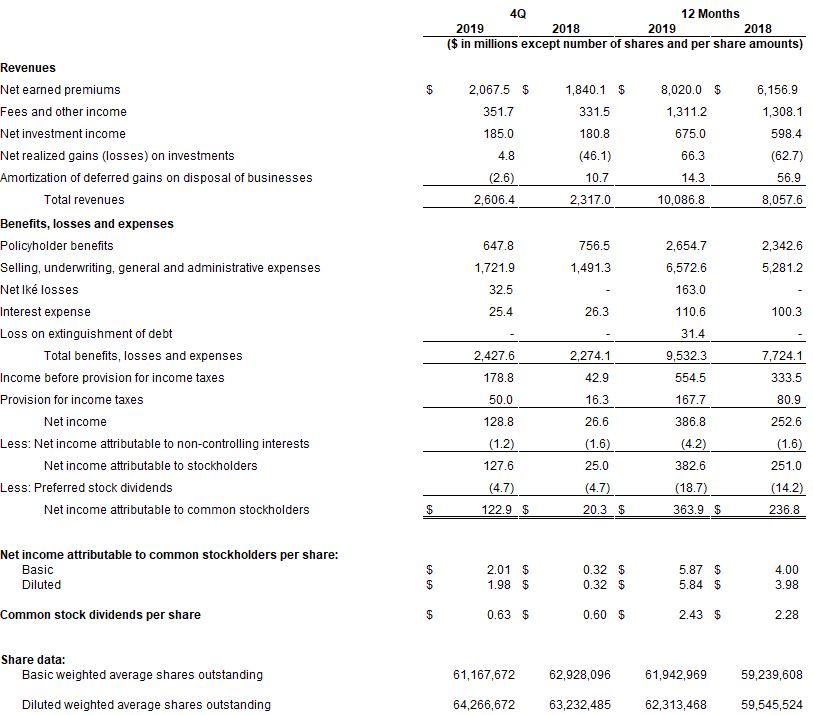

- Net income was $122.9 million, or $1.98 per share, compared to fourth quarter 2018 net income of $20.3 million, or $0.32 per diluted share. The increase was largely driven by $96.0 million of lower reportable catastrophes, the absence of net realized losses on investments, and the reduction of the valuation allowance on the company’s ACA risk corridor program receivables. This increase was partially offset by a $32.5 million after-tax charge related to a decrease in fair value of Iké.

- Net operating income1 increased to $139.9 million, compared to fourth quarter 2018 net operating income of $48.9 million, primarily due to lower reportable catastrophes.

Excluding reportable catastrophes, net operating income2 for fourth quarter 2019 totaled $139.5 million, compared to $144.5 million in the fourth quarter 2018. Results decreased mainly due to the absence of a $9.3 million client recoverable in fourth quarter 2018 in Global Lifestyle and higher non-catastrophe loss experience within our sharing economy offerings in Global Housing. In the fourth quarter 2019, the company also recorded $8.1 million of severance related to the company’s multi-year IT transformation, primarily in Global Lifestyle and Global Housing. Savings are expected to fund investments in technology infrastructure and cloud capabilities. Continued growth in mobile partially offset the decline. - Net operating income per diluted share3 increased to $2.25, compared to fourth quarter 2018 net operating income of $0.77 per diluted share. The calculation for fourth quarter 2018 excluded the effect of 2.9 million shares of dilutive securities related to the mandatory convertible preferred stock, while fourth quarter 2019 included those securities as they were dilutive for the period.

- Net earned premiums, fees and other income from the Global Housing, Global Lifestyle and Global Preneed segments totaled $2.42 billion, an increase of 11 percent from $2.17 billion in fourth quarter 2018, mainly driven by continued organic growth in Connected Living and Global Automotive.

Full-Year 2019 Consolidated Results

- Net income was $363.9 million, or $5.84 per share, compared to full-year 2018 net income of $236.8 million, or $3.98 per diluted share. The increase was driven by $128.7 million of lower reportable catastrophes and expansion in Global Lifestyle, as well as full-year contributions from the TWG acquisition. This was partially offset by $163.9 million of charges related to a change in fair value of Iké following the company’s decision to sell the business. Additional factors are included in the table above.

- Net operating income1 increased to $533.0 million, compared to full-year 2018 net operating income of $345.4 million. The increase was primarily due to lower reportable catastrophes and full-year contributions from TWG.

Excluding reportable catastrophes, net operating income2 for full-year 2019 totaled $574.0 million, compared to $515.1 million for full-year 2018, primarily driven by strong growth in mobile and TWG contributions within Global Lifestyle. Growth was partially offset by a full-year of financing costs related to the TWG acquisition, declines in lender-placed and higher non-catastrophe loss experience within specialty products. - Net operating income per diluted share3 increased to $8.55, compared to full-year 2018 net operating income of $5.80 per diluted share. The calculation excludes the effect of 2.7 million shares and 2.4 million shares, respectively, of dilutive securities related to the mandatory convertible preferred stock, which were anti-dilutive for both periods. Excluding reportable catastrophes, net operating income per diluted share4 increased to $9.21 per diluted share, compared to $8.65 per diluted share for full-year 2018 due to the factors noted above.

- Net earned premiums, fees and other income from the Global Housing, Global Lifestyle and Global Preneed segments totaled $9.33 billion, an increase of 25 percent from $7.46 billion in full-year 2018. TWG contributed an estimated $2.69 billion to full-year 2019 compared to $1.47 billion for 7 months of 2018. Excluding TWG and the sale of mortgage solutions, revenue increased approximately 13 percent, primarily due to growth in Connected Living and Global Automotive.

Reportable Segments

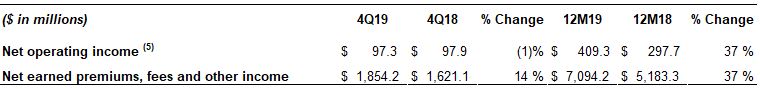

Note: Starting June 1, 2018, the results of TWG business operations is reflected within Global Lifestyle segment results.

- Net operating income was flat in fourth quarter 2019 compared to the prior year period. Fourth quarter 2018 included a $9.3 million favorable client recoverable in Connected Living. Excluding this item and $4.3 million of severance in fourth quarter 2019 to support IT transformation, earnings growth was driven by continued mobile subscriber growth in Asia Pacific and North America, as well as improved operating performance in our European mobile business. This was partially offset by higher expenses in Global Automotive and continued investments in mobile to support future growth.

Full-year 2019 net operating income increased compared to 2018 due to strong organic growth in mobile and full-year contributions from TWG. This was partially offset by continued declines in Global Financial Services. TWG contributed an estimated $130 million for full-year 2019, net of intangible amortization and inclusive of realized operating synergies. This compares to $74.7 million of contributions from TWG operations for 7 months of 2018. - Net earned premiums, fees and other income increased primarily due to the expansion of mobile programs launched over the last three years, as well as growth in Global Automotive.

For the full-year 2019, net earned premiums, fees and other income increased driven primarily by full-year contributions from TWG. TWG contributed an estimated $2.69 billion for full-year 2019 compared to $1.47 billion for 7 months of 2018. Excluding TWG, revenue increased approximately 19 percent due to growth in Connected Living, primarily driven by growth in new mobile subscribers and higher trade-in volumes, along with continued growth in Global Automotive.

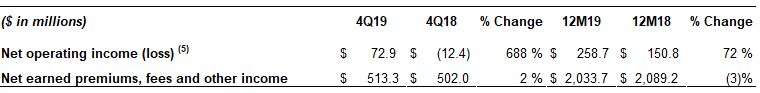

Note: On August 1, 2018, Assurant closed the sale of Global Housing’s mortgage solutions business. Results for this business are included in Global Housing’s revenue and net operating income through July 2018.

- Net operating income increased in fourth quarter 2019, primarily due to $96.3 million of lower reportable catastrophes. Fourth quarter 2019 had $0.9 million of favorable development related to hurricane activity in 2017 and 2018, compared to $95.4 million in reportable catastrophes in the prior year period.

Excluding reportable catastrophes and $2.8 million of fourth quarter 2019 IT severance expense, net operating income declined. This was due to higher non-catastrophe loss experience within our sharing economy offerings and the previously disclosed reduction in loans tracked from a financially insolvent client in lender-placed. The decrease was partially offset by higher premium rates in lender-placed.

Full-year 2019 net operating income increased year-over-year, primarily due to $128.8 million of lower reportable catastrophes. Excluding reportable catastrophes, net operating income decreased, driven by declines in lender-placed mostly from the reduction in loans tracked from a financially insolvent client and higher catastrophe reinsurance program costs to lower 2019 retention, as well as higher non-catastrophe loss experience in specialty products. The decrease was partially offset by the absence of losses from the mortgage solutions business in the prior year period and growth in multifamily housing. - Net earned premiums, fees and other income increased in fourth quarter 2019, primarily from growth in sharing economy offerings and multifamily housing. The increase was partially offset by declines in lender-placed insurance primarily from the reduction in loans from a financially insolvent client.

For the full-year 2019, net earned premiums, fees and other income decreased, reflecting the sale of mortgage solutions. Excluding mortgage solutions, revenue increased 3 percent as growth in specialty property products and multifamily housing were partially offset by declines in lender-placed premiums, which include the impacts of additional catastrophe reinsurance.

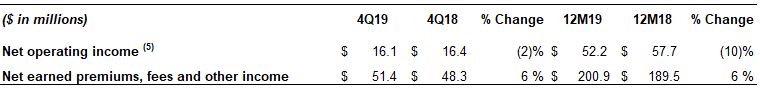

- Net operating income decreased slightly in fourth quarter 2019 due to lower investment income from real estate joint venture partnerships and lower yields compared to the prior year period. The decline was mostly offset by growth in U.S. and a more profitable sales mix from multi-pay products.

Full-year 2019 net operating income decreased primarily due to a previously disclosed $9.9 million charge related to the historical treatment of deferred acquisition costs. Excluding this adjustment, net operating income increased, primarily due to overall growth in the business as well as lower mortality. - Net earned premiums, fees and other income increased in the fourth quarter and full-year 2019, primarily driven by growth in prefunded funeral policies, as well as prior period sales of the Final Need product.

- Net operating loss6 decreased primarily due to a benefit from a consolidating tax rate adjustment and lower employee-related expenses.

For the full year 2019, net operating loss increased, reflecting lower investment income compared to the prior period, which included additional assets held in anticipation of closing the TWG acquisition. This was partially offset by lower employee-related expenses.

Holding Company Liquidity Position

- Holding company liquidity totaled $534 million as of December 31, 2019, or $309 million above the company’s current targeted minimum level of $225 million.

Dividends paid by operating segments to the holding company in the fourth quarter 2019 totaled $276 million. In addition, Assurant received upfront cash of approximately $27 million associated with the sale of its right to any future claim proceeds related to its ACA risk corridor program receivables. For the full-year 2019, dividends paid to the holding company totaled $748 million. - Share repurchases and common and preferred dividends totaled $152 million in fourth quarter 2019. Dividends to shareholders totaled $43 million, including $38 million in common stock dividends and $5 million in preferred stock dividends. During fourth quarter, 2019, Assurant repurchased 0.8 million shares of common stock for $109 million. From January 1 through February 7, 2020, the company repurchased an additional 153,000 shares for approximately $20 million, with $466 million remaining under the current repurchase authorization.

For full-year 2019, share repurchases and common and preferred dividends totaled $445 million. Assurant repurchased 2.4 million shares of common stock for $275 million and paid dividends to shareholders totaling $170 million, including $151 million in common stock dividends and $19 million in preferred stock dividends.

Company Outlook

For full-year 2020, the company expects:

- Assurant net operating income per diluted share, excluding catastrophe losses7, to increase 10 percent to 14 percent from $9.21 in 2019. This will be driven by profitable growth across all business segments, as well as share repurchases. Mandatory convertible shares are expected to be dilutive for the year versus anti-dilutive in 2019.

- Net operating income growth, excluding catastrophes, to reflect modest growth in Global Lifestyle driven primarily by Connected Living, and to a lesser extent Global Automotive. This will be partially offset by continued declines in legacy Global Financial Services and investments to support growth. Global Housing earnings, excluding catastrophe losses, to expand across all business lines, partially offset by the previously disclosed loss of loans from a financially insolvent client.

Corporate and Other full-year net operating loss7 to approximate $85 million, consistent with 2019, benefitting from ongoing expense efficiencies. Interest expense and preferred dividends are expected to be approximately $81 million and $19 million, respectively. - Business segment dividends from Global Lifestyle, Global Housing and Global Preneed to approximate segment net operating income, including catastrophe losses. This is subject to the growth of the businesses, and rating agency and regulatory capital requirements.

- Capital to be deployed to support business growth, fund investments and return capital to shareholders in the form of share repurchases and dividends, subject to Board approval and market conditions.

Earnings Conference Call

The fourth quarter 2019 earnings conference call and webcast will be held Wednesday, February 12, 2020 at 8:00 a.m. ET. The live and archived webcast, along with supplemental information, will be available on Assurant’s Investor Relations website http://ir.assurant.com/investor/default.aspx.

About Assurant

Assurant, Inc. (NYSE: AIZ) is a leading global provider of lifestyle and housing solutions that support, protect and connect major consumer purchases. Anticipating the evolving needs of consumers, Assurant partners with the world’s leading brands to develop innovative products and services and to deliver an enhanced customer experience. A Fortune 500 company with a presence in 21 countries, Assurant offers mobile device solutions; extended service contracts; vehicle protection services; pre-funded funeral insurance; renters insurance; lender-placed insurance products; and other specialty products. The Assurant Foundation strengthens communities by supporting charitable partners that help protect where people live and can thrive, connect with local resources, inspire inclusion and prepare leaders of the future.

Learn more at assurant.com or on Twitter @AssurantNews.

Media Contact:

Linda Recupero

Senior Vice President, Global Communication

212.859.7005

[email protected]

Investor Relations Contact:

Sean Moshier

Director, Investor Relations

212.859.5831

[email protected]

Safe Harbor Statement

Some of the statements included in this news release and its exhibits, particularly those anticipating future financial performance, business prospects, growth and operating strategies and similar matters, are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these statements by the use of words such as “outlook,” “will,” “may,” “can,” “anticipates,” “expects,” “estimates,” “projects,” “intends,” “plans,” “believes,” “targets,” “forecasts,” “potential,” “approximately,” and the negative version of those words and other words and terms with a similar meaning. Any forward-looking statements contained in this news release or its exhibits are based upon our historical performance and on current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that our future plans, estimates or expectations will be achieved. Our actual results might differ materially from those projected in the forward-looking statements. We undertake no obligation to update or review any forward-looking statement, whether as a result of new information, future events or other developments. The following factors could cause our actual results to differ materially from those currently estimated by management, including those projected in the company outlook:

| (i) | the loss of significant clients, distributors or other parties with whom we do business, or if we are unable to renew contracts with them on favorable terms, or those parties facing financial, reputational or regulatory issues; |

| (ii) | significant competitive pressures, changes in customer preferences and disruption; |

| (iii) | the failure to find suitable acquisitions, integrate completed acquisitions, or grow organically, and risks associated with joint ventures and franchise ownership and operations; |

| (iv) | the impact of general economic, financial market and political conditions, including unfavorable conditions in the capital and credit markets, and conditions in the markets in which we operate; |

| (v) | risks related to our international operations, including the United Kingdom’s withdrawal from the European Union, or fluctuations in exchange rates; |

| (vi) | the impact of catastrophic and non-catastrophe losses, including as a result of climate change; |

| (vii) | our inability to recover should we experience a business continuity event; |

| (viii) | our inability to develop and maintain distribution sources or attract and retain sales representatives and executives with key client relationships; |

| (ix) | the failure to manage vendors and other third parties on whom we rely to conduct business and provide services to our clients; |

| (x) | declines in the value of mobile devices, the risk of guaranteed buybacks or export compliance risk in our mobile business; |

| (xi) | negative publicity relating to our products and services or the markets in which we operate; |

| (xii) | the failure to implement our strategy and to attract and retain key personnel, including senior management; |

| (xiii) | employee misconduct; |

| (xiv) | the adequacy of reserves established for claims and our inability to accurately predict and price for claims; |

| (xv) | a decline in financial strength ratings or corporate senior debt ratings; |

| (xvi) | an impairment of goodwill or other intangible assets; |

| (xvii) | the failure to maintain effective internal control over financial reporting; |

| (xviii) | a decrease in the value of our investment portfolio including due to market, credit and liquidity risks and changes in interest rates; |

| (xix) | the impact of U.S. tax reform legislation and impairment of deferred tax assets; |

| (xx) | the unavailability or inadequacy of reinsurance coverage and the credit risk of reinsurers, including those to whom we have sold business through reinsurance; |

| (xxi) | the credit risk of some of our agents, third-party administrators and clients; |

| (xxii) | the inability of our subsidiaries to pay sufficient dividends to the holding company and limitations on our ability to declare and pay dividends; |

| (xxiii) | changes in the method for determining LIBOR or the replacement of LIBOR; |

| (xxiv) | the failure to effectively maintain and modernize our information technology systems and infrastructure, or the failure to integrate those of acquired businesses; |

| (xxv) | breaches of our information systems or those of third parties with whom we do business, or the failure to protect data in such systems, including due to cyber-attacks; |

| (xxvi) | the costs of complying with, or the failure to comply with, extensive laws and regulations to which we are subject, including those related to privacy, data security and data protection; |

| (xxvii) | the impact from litigation and regulatory actions; |

| (xxviii) | reductions in the insurance premiums we charge; and |

| (xxix) | changes in insurance and other regulation. |

For additional information on factors that could affect our actual results, please refer to the factors identified in the reports we file with the U.S. Securities and Exchange Commission (the “SEC”), including but not limited to the risk factors identified in our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, each as filed with the SEC.

Non-GAAP Financial Measures

Assurant uses the following non-GAAP financial measures to analyze the company’s operating performance for the periods presented in this news release. Because Assurant’s calculation of these measures may differ from similar measures used by other companies, investors should be careful when comparing Assurant’s non-GAAP financial measures to those of other companies.

- Assurant uses net operating income as an important measure of the company’s operating performance. Net operating income equals net income attributable to common stockholders, excluding the net charge related to Iké, Assurant Health runoff operations, net realized gains (losses) on investments, amortization of deferred gains (including Assurant Employee Benefits), net charges relating to the acquisition of The Warranty Group (TWG), foreign exchange gains (losses) from remeasurement of monetary assets and liabilities, loss on sale of mortgage solutions and other highly variable or unusual items other than reportable catastrophes. The company believes net operating income provides investors with a valuable measure of the performance of the company’s ongoing business because the excluded items do not represent the ongoing operations of the company. The comparable GAAP measure is net income attributable to common stockholders.

- Assurant uses net operating income (defined above), excluding reportable catastrophes (which represents catastrophe losses net of reinsurance and client profit sharing adjustments and including reinstatement and other premiums), as another important measure of the company’s operating performance. The company believes this metric provides investors with a valuable measure of the performance of the company’s ongoing business because it excludes reportable catastrophes, which can be volatile. The comparable GAAP measure is net income attributable to common stockholders.

- Assurant uses net operating income per diluted share as an important measure of the company’s stockholder value. Net operating income per diluted share equals net operating income (defined above) divided by weighted average diluted shares outstanding, excluding any dilutive effect from the assumed conversion of the mandatory convertible preferred stock prior to the TWG acquisition date. The company believes this metric provides investors with a valuable measure of stockholder value because it excludes items that do not represent the ongoing operations of the company. In addition, it excludes the effect of the mandatory convertible preferred stock, which was used to finance the TWG acquisition, prior to the TWG acquisition date. The comparable GAAP measure is net income attributable to common stockholders per diluted share, defined as net income attributable to common stockholders plus any dilutive preferred stock dividends divided by weighted average diluted shares outstanding.

(1) Information on the share counts used in the per share calculations are included in the Financial Supplement located on Assurant’s Investor Relations website http://ir.assurant.com/investor/default.aspx.

- Assurant uses net operating income per diluted share, excluding reportable catastrophes, as another important measure of the company's stockholder value. The company believes this metric provides investors with a valuable measure of stockholder value because it excludes reportable catastrophes, which can be volatile. The comparable GAAP measure is net income attributable to common stockholders per diluted share, defined as net income attributable to common stockholders plus any dilutive preferred stock dividends divided by weighted average diluted shares outstanding.

(1) Information on the share counts used in the per share calculations are included in the Financial Supplement located on Assurant’s Investor Relations website http://ir.assurant.com/investor/default.aspx.

- Segment net operating income of the Global Housing, Global Lifestyle and Global Preneed operating segments is equal to GAAP segment net income.

- Assurant uses Corporate and Other net operating loss as an important measure of the corporate segment’s performance. Corporate and Other net operating loss equals Total Corporate and Other segment net loss attributable to common stockholders, excluding the net charge related to Iké, Assurant Health runoff operations, net TWG acquisition related charges, foreign exchange gains (losses) from remeasurement of monetary assets and liabilities, amortization of deferred gains on disposal of businesses, net realized gains (losses) on investments, interest expense, loss on sale of mortgage solutions and other highly variable or unusual items. The company believes Corporate and Other net operating loss provides investors with a valuable measure of the performance of the company’s corporate segment because it excludes highly variable items that do not represent the ongoing results of the company’s corporate segment. The comparable GAAP measure is Total Corporate & Other segment net loss attributable to common stockholders.

- The company outlook for net operating income per diluted share, excluding reportable catastrophe losses, and Corporate and Other net operating loss each constitute forward-looking information and the company believes that it cannot reconcile such forward-looking information to the most comparable GAAP measure without unreasonable efforts. Many of the GAAP components cannot be reliably quantified due to the combination of variability and volatility of such components and may, depending on the size of the components, have a significant impact on the reconciliation. The company is able to reasonably quantify a range for amortization of deferred gains based on certain assumptions relating to future reinsured premium on disposed business during the forecast period. Amortization of deferred gains on disposal of businesses is expected to be approximately $8-9 million after-tax. The company is also able to quantify a range of interest expense and preferred stock dividends, as disclosed in the outlook. The interest expense estimate assumes no additional debt is incurred or extinguished in the forecast period and excludes after-tax interest expenses included in debt extinguishment and other related costs. Preferred stock dividends are subject to Board approval.

(1) Additional details about the components of net TWG acquisition related charges, the components of Other adjustments and other key financial metrics are included in the Financial Supplement located on Assurant’s Investor Relations website http://ir.assurant.com/investor/default.aspx.

(1) 4Q 2019 and 4Q 2018 exclude losses of $0.5 million after-tax ($0.6 million pre-tax) and $0.2 million after-tax ($0.2 million pre-tax), respectively. Twelve Months 2019 excludes a loss of $0.1 million after-tax ($0.1 million benefit pre-tax). No reportable catastrophes were excluded for Twelve Months 2018 as favorable development related to prior year reportable catastrophes offset the 4Q 2018 loss.

(2) Additional details about the components of net TWG acquisition related charges, the components of Other adjustments and other key financial metrics are included in the Financial Supplement located on Assurant’s Investor Relations website http://ir.assurant.com/investor/default.aspx.

(1) Additional details about the components of net TWG acquisition related charges, the components of Other adjustments and other key financial metrics are included in the Financial Supplement located on Assurant’s Investor Relations website http://ir.assurant.com/investor/default.aspx.

A summary of net operating income disclosed items is included on page 15 of the company’s Financial Supplement, which is available on Assurant’s Investor Relations website http://ir.assurant.com/investor/default.aspx.

Assurant, Inc.

Consolidated Statement of Operations (unaudited)

Three Months and Twelve Months Ended December 31, 2019 and 2018

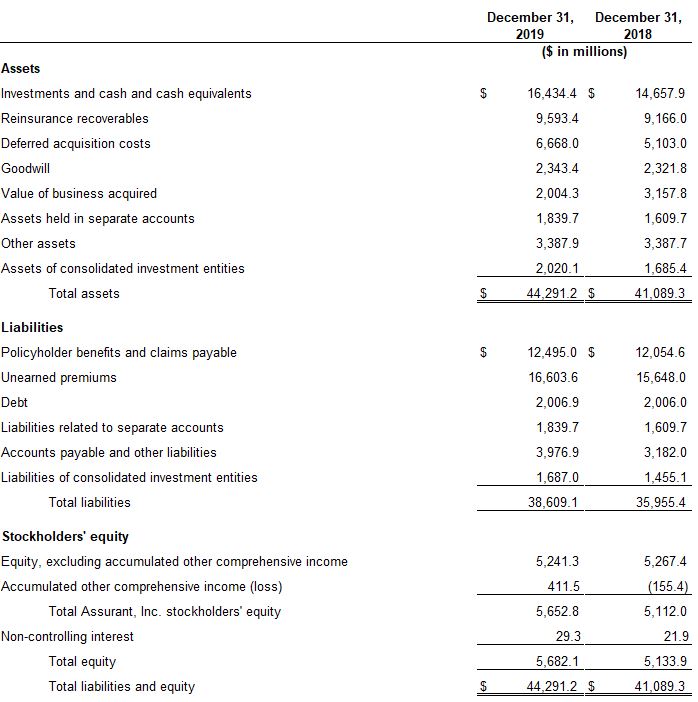

Assurant, Inc.

Consolidated Condensed Balance Sheets (unaudited)

At December 31, 2019 and December 31, 2018