NEW YORK, August 29, 2019 — Assurant, Inc. (NYSE: AIZ) (“Assurant”), a leading global provider of housing and lifestyle solutions that support, protect and connect major consumer purchases, today announced the pricing terms of its previously-announced cash tender offer (the “Offer”) to purchase up to $100,000,000 aggregate principal amount (the “Tender Cap”) of its 6.750% Senior Notes due 2034 (the “Notes”) ,as well as the anticipated early settlement date for the Offer on August 30, 2019 (the “Early Settlement Date”), as previously announced.

The Offer commenced on August 15, 2019 and will expire at 11:59 p.m., New York City time, on September 12, 2019 (such time and date, as the same may be extended, the “Expiration Date”). No tenders will be valid if submitted after the Expiration Date. The terms and conditions of the Offer are described in the Offer to Purchase, dated August 15, 2019 (as it may be amended or supplemented from time to time, the “Offer to Purchase”).

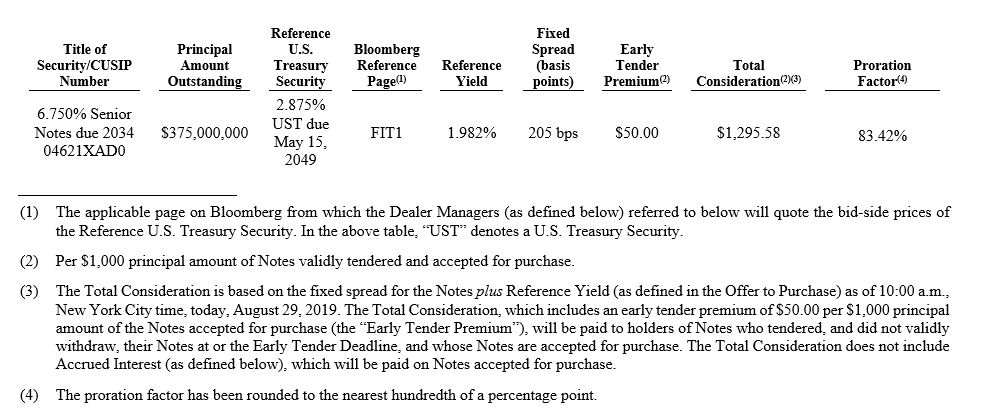

The following table sets forth some of the terms of the Offer:

Because the principal amount of Notes validly tendered and not validly withdrawn at or prior to 5:00 p.m., New York City time, on August 28, 2019 (the “Early Tender Deadline”) exceeded the Tender Cap, Assurant will accept the Notes for purchase on a pro rata basis based on the proration factor set forth in the table above. In addition, Assurant will not accept any Notes tendered after the Early Tender Deadline.

The deadline to validly withdraw tenders was 5:00 p.m., New York City time, on August 28, 2019, and no withdrawal rights shall exist for tenders submitted after such time except in certain limited circumstances where additional withdrawal rights are required by law. Only holders of Notes that validly tendered and did not validly withdraw their Notes at or prior to the Early Tender Deadline will be eligible to receive the Total Consideration on the Early Settlement Date, subject to the satisfaction or waiver of all conditions to the Offer.

Payments for Notes purchased will include accrued and unpaid interest from and including the most recent interest payment date for the Notes up to, but not including, the applicable settlement date.

Tenders of Notes will be accepted only in principal amounts equal to $1,000 or integral multiples thereof. The Offer is not conditioned on any minimum principal amount of Notes being tendered. Assurant’s obligation to accept for payment and to pay for the Notes validly tendered and not validly withdrawn in the Offer is subject to the satisfaction or waiver of a number of conditions described in the Offer to Purchase. The Financing Condition described in the Offer to Purchase was satisfied on August 22, 2019, upon Assurant’s consummation of an offering of senior debt securities in an aggregate principal amount of $350,000,000. Assurant reserves the absolute right, subject to applicable law, to: (i) waive any or all conditions to the Offer; (ii) extend, terminate or withdraw the Offer; or (iii) otherwise amend the Offer in any respect.

None of Assurant or its board of directors, J.P. Morgan Securities LLC and Wells Fargo Securities, LLC (the “Dealer Managers”), D.F. King & Co., Inc. (the “Tender and Information Agent”), or U.S. Bank National Association (as successor to SunTrust Bank), as trustee under the indenture pursuant to which the Notes were issued, is making any recommendation as to whether Holders should tender any Notes in the Offer. Holders must make their own decision as to whether to tender any of their Notes, and, if so, the principal amount of Notes to tender. You should consult your own tax, accounting, financial and legal advisers as you deem appropriate regarding the suitability of the tax, accounting, financial and legal consequences of participating or declining to participate in the Offer.

Information Relating to the Offer

Assurant has retained J.P. Morgan Securities LLC and Wells Fargo Securities, LLC as Dealer Managers. D.F. King & Co., Inc. is the Tender and Information Agent. For additional information regarding the terms of the tender offer, please contact J.P. Morgan Securities LLC at (866) 834-4666 (toll-free) or (212) 834-3424 (collect) or Wells Fargo Securities, LLC at (866) 309-6316 (toll-free) or (704) 410-4756 (collect). Requests for documents and questions regarding the tendering of securities may be directed to D.F. King & Co., Inc. by telephone at (212) 269-5550 (for banks and brokers only), (877) 864-5060 (for all others toll-free) or by email at [email protected] or to the Dealer Managers at the above telephone numbers.

This press release does not constitute an offer or an invitation by Assurant to participate in the Offer in any jurisdiction in which it is unlawful to make such an offer or solicitation. The Offer is being made only pursuant to the Offer to Purchase, and the information in this press release is qualified by reference to such Offer to Purchase. This press release is not an offer to purchase any other securities of Assurant, including the new debt securities.

About Assurant

Assurant is a leading global provider of housing and lifestyle solutions that support, protect and connect major consumer purchases. Anticipating the evolving needs of consumers, Assurant partners with the world’s leading brands to develop innovative products and services and to deliver an enhanced customer experience. A Fortune 500 company with a presence in 21 countries, Assurant offers mobile device solutions; extended service contracts; vehicle protection services; pre-funded funeral insurance; renters insurance and lender-placed homeowners insurance. The Assurant Foundation strengthens communities by supporting charitable partners that help protect where people live and can thrive, connect with local resources, inspire inclusion and prepare leaders of the future.

Cautionary Statement

Some of the statements included in this press release may constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Any forward-looking statements contained in this press release are based upon our historical performance and on current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that our future plans, estimates or expectations will be achieved. Our actual results might differ materially from those projected in the forward-looking statements. The company undertakes no obligation to update or review any forward-looking statement in this press release, whether as a result of new information, future events or other developments. For a detailed discussion of the factors that could affect the company’s results, please refer to the factors identified in the reports we file with the U.S. Securities and Exchange Commission (the “SEC”), including but not limited to the risk factors identified in our most recent Annual Report on Form 10-K, as filed with the SEC.

# # #

Media Contact:

Linda Recupero

Senior Vice President, Enterprise Communication

212.859.7005

[email protected]

Investor Relations Contacts:

Suzanne Shepherd

Senior Vice President, Investor Relations

212.859.7062

[email protected]

Sean Moshier

Director, Investor Relations

212.859.5831

[email protected]