1Q 2017 Net Income of $143.8 million, $2.53 per diluted share

1Q 2017 Net Operating Income of $105.9 million, $1.87 per diluted share

|

•$106.5 million of net operating income, excluding catastrophe losses1 |

NEW YORK, May 2, 2017 — Assurant, Inc. (NYSE: AIZ), a premier global provider of risk management solutions, today reported results for first quarter ended March 31, 2017.

“We delivered solid first quarter results due mainly to better underlying profitability in extended services contracts and certain one-time items,” said Assurant President and Chief Executive Officer Alan Colberg.

“We are confident that growth in targeted areas and expense efficiencies will enable us to deliver on our 2017 earnings and capital deployment commitments, despite lender-placed insurance and legacy business declines,” he added. “While results may vary by quarter, our ongoing transformation is solidifying a foundation for profitable growth in 2018 and beyond.”

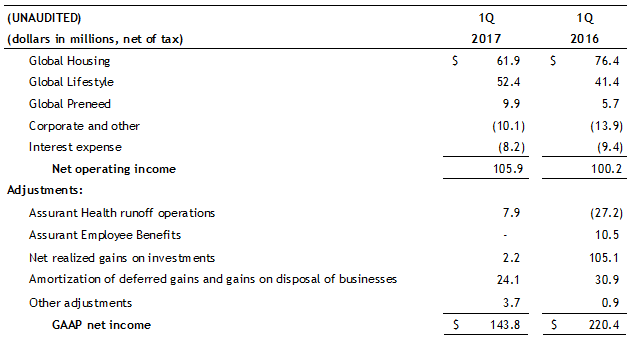

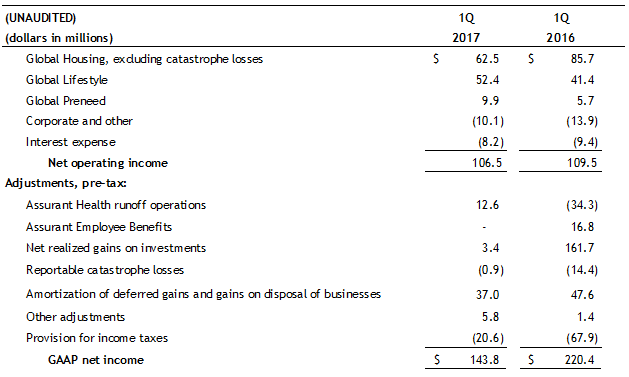

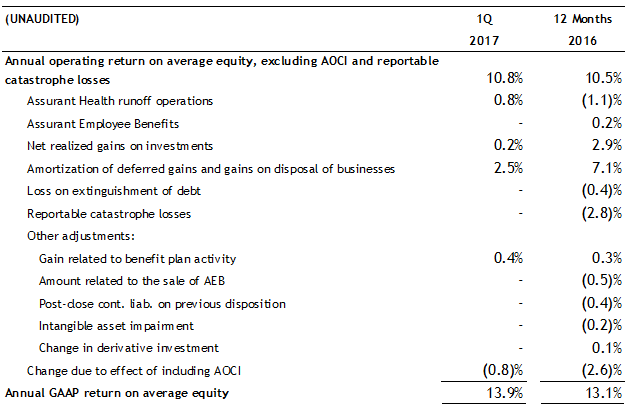

Reconciliation of Net Operating Income to GAAP Net Income

Note: Beginning with first quarter 2017, all amounts (excluding share and per share amounts) are presented in millions. Prior period amounts have been updated to reflect the current presentation and may result in rounding differences.

Additional financial information, including a schedule of disclosed items that affected Assurant’s results by business for the last eight quarters, appears on page 19 of the company’s Financial Supplement and is located in the Investor Relations section of www.assurant.com.

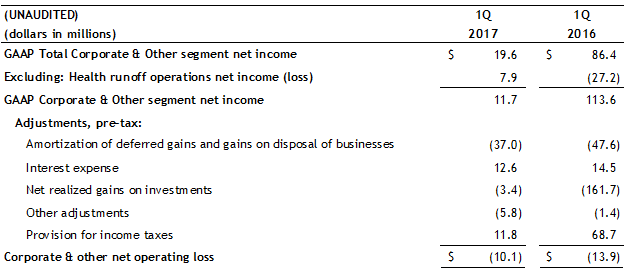

First Quarter 2017 Consolidated Results

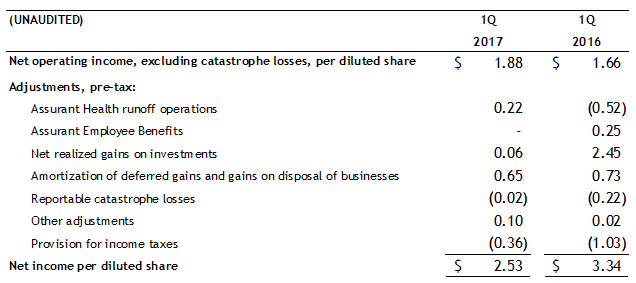

- Net income was $143.8 million, or $2.53 per diluted share, compared to first quarter 2016 net income of $220.4 million, or $3.34 per diluted share, primarily related to $102.9 million of lower net realized gains on investments mainly associated with the sale of Assurant Employee Benefits. The reduction was partially offset by $7.5 million of one-time client recoverables and improved extended service contract profitability in Global Lifestyle.

- Net operating income4 increased to $105.9 million, or $1.87 per diluted share, compared to first quarter 2016 net operating income of $100.2 million, or $1.52 per diluted share. This increase was primarily due to one-time client recoverables and improved extended service contract profitability in Global Lifestyle, partially offset by ongoing declines in lender-placed insurance in Global Housing. First quarter 2017 also benefited from lower reportable catastrophes inclusive of a favorable prior-period reserve development. Excluding catastrophe losses, net operating income for first quarter 2017 decreased to $106.5 million compared to $109.5 million in the prior-year period.

- Net earned premiums, fees and other income from the Global Housing, Global Lifestyle and Global Preneed segments totaled $1.38 billion compared to $1.55 billion in first quarter 2016. The decline primarily reflects a change in program structure implemented in fourth quarter 2016 for a large service contract client in Global Lifestyle and declines in lender-placed insurance.

Reportable Segments

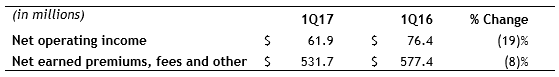

Global Housing

- Net operating income decreased in first quarter 2017, primarily due to ongoing lender-placed insurance normalization and weaker performance in the mortgage solutions business. Net reportable catastrophe losses totaled $0.6 million in first quarter 2017, compared to $9.3 million of reportable catastrophe losses in first quarter 2016. First quarter 2017 net reportable catastrophe losses included a $3.4 million favorable reserve development related to Hurricane Matthew.

- Net earned premiums, fees and other income decreased in first quarter 2017, primarily due to expected lower placements and lower premium rates in lender-placed insurance. Growth in multifamily housing and new client revenue in lender-placed partly offset the decline. Fee income decreased, mainly from weaker market conditions and lower client volumes in mortgage solutions.

- Combined ratio for risk-based businesses(a) increased to 82.9 percent in the first quarter 2017 from 80.7 percent in prior-year quarter. This primarily resulted from lower lender-placed revenue as well as higher expenses to onboard new client loans. However, loss experience improved in the quarter, reflecting lower net reportable catastrophe claims, partially offset by a modest increase in the severity of non-catastrophe claims.

- Pre-tax margin for fee-based, capital-light businesses(b) was 8.8 percent, down from 11.0 percent from the first quarter of 2016. The decrease resulted from lower mortgage solutions revenue, largely attributable to weaker market conditions for valuation and field services and lower client volumes. Growth from affinity relationships in multifamily housing partially offset these declines.

(a) Combined ratio for the Global Housing risk-based businesses is equal to total policyholder benefits, losses and expenses, including reportable catastrophe losses, divided by net earned premiums and fees and other income, for lender-placed and manufactured housing and other businesses.

(b) Pre-tax margin for the Global Housing fee-based, capital-light businesses is equal to income before provision for income taxes divided by total net earned premiums, fees and other income, for multifamily housing and mortgage solutions businesses.

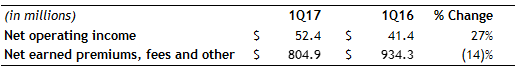

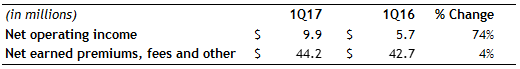

Global Lifestyle

- Net operating income increased in first quarter 2017 in part driven by $7.5 million of one-time client recoverables from Connected Living and credit insurance resulting from actions taken to improve profitability in select international markets. Excluding these client recoverables, earnings increased driven by higher contributions from extended service contracts and volume growth in vehicle protection contracts, partially offset by less favorable mobile loss experience in Europe.

- Net earned premiums, fees and other income decreased compared to first quarter 2016 due to a change in program structure implemented in the fourth quarter 2016 for a large service contract client in Connected Living. Excluding this $137 million reduction and the client recoverables, first quarter 2017 revenue was level with the prior-year period as growth from vehicle protection contracts and international credit was offset by declines from legacy retail clients.

- Combined ratio for risk-based businesses(a) improved to 92.2 percent from 94.6 percent in first quarter 2016, driven largely by $4.3 million pre-tax of client recoverables as well as favorable loss experience in credit insurance.

- Pre-tax margin for fee-based, capital-light businesses(b) was 7.1 percent, up from 4.5 percent in first quarter 2016. The increase was largely driven by the change in client program structure and $6.7 million pre-tax of client recoverables. Improved extended service contract profitability from original equipment manufacturers and other distribution channels helped offset less favorable mobile loss experience in Europe.

(a) Combined ratio for the Global Lifestyle risk-based businesses is equal to total policyholder benefits, losses and expenses, divided by net earned premiums and fees and other income, for vehicle protection, credit and other businesses.

(b) Pre-tax margin for the Global Lifestyle fee-based, capital-light businesses is equal to income before provision for income taxes divided by total net earned premiums, fees and other income, for Connected Living, including mobile, extended service contracts and assistance services.

Global Preneed

- Net operating income increased in first quarter 2017 relative to first quarter 2016. The prior period included a $3.9 million net adjustment related to additional reserves and the amortization of deferred acquisition costs for an older block of preneed policies. Excluding this adjustment, earnings for the quarter increased slightly compared to the year-ago period, as additional investment income and expense efficiencies offset an increase in mortality.

- Net earned premiums, fees and other income increased modestly due primarily to sales written in prior years that are now beginning to earn.

- Face sales totaled $235.8 million in first quarter 2017 compared to $227.0 million in first quarter 2016, as Global Preneed continued to benefit from its alignment with market leaders.

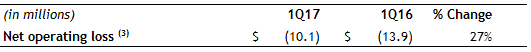

Corporate & Other

- Net operating loss5 declined in first quarter 2017, primarily due to lower employee-related costs and higher investment income from increased assets held at the holding company.

Capital Position

- Corporate capital approximated $605 million as of March 31, 2017. Deployable capital totaled approximately $355 million, net of the company’s $250 million risk buffer.

Dividends from the businesses paid to the holding company in first quarter 2017 totaled $43 million. This included $15 million from Assurant Health and $28 million from Global Housing, Global Lifestyle and Global Preneed operating segments.

- Share repurchases and dividends totaled $135 million in first quarter 2017. Dividends to shareholders totaled $30 million, and Assurant repurchased approximately 1.1 million shares of common stock for $105 million. From April 1 through April 28, 2017, the company repurchased an additional 398,600 shares for approximately $38 million, with $540 million remaining under the current repurchase authorization.

Company Outlook

Based on current market conditions, for full-year 2017 Assurant continues to expect:

- Assurant net operating income, excluding reportable catastrophe losses, to be roughly level with 2016 results, excluding catastrophe losses, as profitable growth primarily in fee-based, capital-light offerings — comprising Connected Living, multifamily housing and mortgage solutions — and vehicle protection is offset by declines in lender-placed insurance and other legacy businesses. Expense savings from enterprise transformation projects are expected to be reinvested in the business.

- Assurant operating earnings per diluted share, excluding catastrophe losses, to grow double-digits from 2016 primarily due to share repurchase activity.

- Global Housing net earned premiums and net operating income, excluding reportable catastrophe losses, to decrease from 2016 due to the ongoing lender-placed insurance normalization. Results to be partially offset by expense savings and profitable growth from fee-based, capital-light business.

- Global Lifestyle to increase net operating income as a result of improved performance in Connected Living driven primarily by growth in mobile, as well as higher contributions from vehicle protection and from expense efficiencies. Declines in legacy credit insurance and retail clients to continue. Revenue expected to decrease, largely due to a change in program structure for a large service contract client. Under the new structure, the overall economics of the program are maintained with no impact to profitability, however net earned premiums will be lower by approximately $500 million compared to 2016 with a commensurate reduction in expenses. Excluding this, net earned premiums and fee income to increase from growth in Connected Living and vehicle protection globally. Results to be impacted by foreign exchange.

- Global Preneed fee income and earnings to increase due to sales growth across North America from our alignment with market leaders and operational efficiencies.

- Corporate & Other6 full-year net operating loss to be level with 2016 at approximately $70 million as continued expense initiatives are offset by investments to support our multi-year transformation.

- Capital to be deployed through a combination of share repurchases, common stock dividends, and reinvestments and acquisitions in the business, subject to market conditions and other factors. Business segment dividends from Global Housing, Global Lifestyle and Global Preneed to approximate segment net operating income including catastrophe losses, subject to the growth of the businesses, rating agency and regulatory capital requirements. In addition to the $15 million received year to date, approximately $85 million in dividends expected from Assurant Health and Assurant Employee Benefits, subject to regulatory approval.

Earnings Conference Call

The first quarter 2017 earnings conference call and webcast will be held Wednesday, May 3, 2017 at 8:00 a.m. ET. The live and archived webcast, along with supplemental information, will be available in the Investor Relations section of www.assurant.com.

About Assurant

Assurant, Inc. (NYSE: AIZ) is a global provider of risk management solutions, protecting where consumers live and the goods they buy. A Fortune 500 company, Assurant focuses on the housing and lifestyle markets, and is among the market leaders in mobile device protection and related services; extended service contracts; vehicle protection; pre-funded funeral insurance; renters insurance; lender-placed homeowners insurance; and mortgage valuation and field services. With approximately $30 billion in assets and $6 billion in annualized revenue as of March 31, 2017, Assurant has a market presence in 17 countries, while its Assurant Foundation works to support and improve communities. Learn more at assurant.com or on Twitter @AssurantNews.

Media Contact:

John M. Moran

Vice President, External Communication

Phone: 212.859.7002

[email protected]

Investor Relations Contact:

Sean Moshier

Manager, Investor Relations

Phone: 212.859.5831

[email protected]

Safe Harbor Statement

Some of the statements included in this news release and its exhibits, particularly those anticipating future financial performance, business prospects, growth and operating strategies and similar matters, are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these statements by the use of words such as “outlook,” “will,” “may,” “anticipates,” “expects,” “estimates,” “projects,” “intends,” “plans,” “believes,” “targets,” “forecasts,” “potential,” “approximately,” or the negative version of those words and other words and terms with a similar meaning. Any forward-looking statements contained in this news release or its exhibits are based upon our historical performance and on current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. Our actual results might differ materially from those projected in the forward-looking statements. The company undertakes no obligation to update or review any forward-looking statements in this news release or the exhibits, whether as a result of new information, future events or other developments. The following risk factors could cause our actual results to differ materially from those currently estimated by management, including those projected in the company outlook:

| (i) | loss of significant client relationships or business, distribution sources or contracts and reliance on a few clients; |

| (ii) | general global economic, financial market and political conditions and conditions in the markets in which we operate, including uncertainty surrounding the new administration; |

| (iii) | failure to adequately predict or manage claims and other costs; |

| (iv) | inadequacy of reserves established for future claims; |

| (v) | losses due to natural or man-made catastrophes; |

| (vi) | a decline in our credit or financial strength ratings; |

| (vii) | risks related to our international operations, including fluctuations in exchange rates; |

| (viii) | deterioration in our market capitalization compared to its book value that could result in an impairment of goodwill; |

| (ix) | failure to maintain effective internal control over financial reporting; |

| (x) | failure to effectively maintain and modernize our information technology systems; |

| (xi) | data breaches compromising client information and privacy; |

| (xii) | cyber security threats and cyber-attacks; |

| (xiii) | significant competitive pressures in our businesses; |

| (xiv) | inability to execute strategic plans related to acquisitions, dispositions or new ventures or integrate them effectively; |

| (xv) | failure to develop or maintain distribution sources or attract and retain sales representatives; |

| (xvi) | diminished value of invested assets in our investment portfolio (due to, among other things, volatility in financial markets; the global economic slowdown; credit, currency and liquidity risk; other than temporary impairments and increases in interest rates); |

| (xvii) | unfavorable outcomes in litigation and/or regulatory investigations that could negatively affect our results, business and reputation; |

| (xviii) | current or new laws and regulations that could increase our costs and decrease our revenue; |

| (xix) | uncertain tax positions, changes in tax laws and unexpected tax liabilities; |

| (xx) | risks related to outsourcing activities; |

| (xxi) | decline in the value of mobile devices in our inventory or subject to guaranteed buyback; |

| (xxii) | employee misconduct; |

| (xxiii) | unavailability, inadequacy and unaffordable pricing of reinsurance coverage; |

| (xxiv) | insolvency of third parties to whom we have sold or may sell businesses through reinsurance or modified co-insurance; |

| (xxv) | inability of reinsurers to meet their obligations; |

| (xxvi) | credit risk of some of our agents; |

| (xxvii) | inability of our subsidiaries to pay sufficient dividends; and |

| (xxviii) | failure to successfully execute our transformation, retain and hire qualified personnel including key executives and provide for succession of key executives. |

For a detailed discussion of the risk factors that could affect our actual results, please refer to the risk factors identified in our SEC reports, including, but not limited to our Annual Report on Form 10-K, as filed with the SEC.

Non-GAAP Financial Measures

Assurant uses the following non-GAAP financial measures to analyze the company’s operating performance for the periods presented in this news release. Because Assurant’s calculation of these measures may differ from similar measures used by other companies, investors should be careful when comparing Assurant’s non-GAAP financial measures to those of other companies.

- Assurant uses net operating income (as defined below), excluding reportable catastrophe losses, as an important measure of the company’s operating performance. The company believes net operating income, excluding reportable catastrophe losses, provides investors a valuable measure of the performance of the company’s ongoing business because it excludes the effect of reportable catastrophe losses, which can be volatile. The comparable GAAP measure is net income.

- Assurant uses net operating income (as defined below) per diluted share, excluding reportable catastrophe losses, as an important measure of the company's stockholder value. The company believes this metric provides investors a valuable measure of stockholder value because it excludes the effect of reportable catastrophe losses, which can be volatile. The comparable GAAP measure is net income per diluted share, defined as net income divided by weighted average diluted shares outstanding.

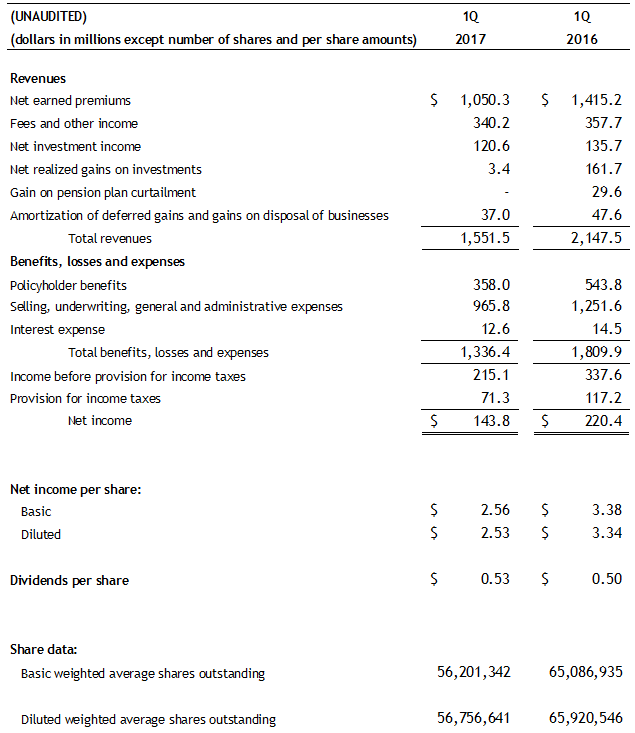

- Assurant uses operating return on equity ("Operating ROE"), excluding accumulated other comprehensive income ("AOCI") and reportable catastrophe losses, as an important measure of the company’s operating performance. Operating ROE, excluding AOCI and reportable catastrophe losses, equals net operating income (as defined below) for the periods presented divided by average stockholders’ equity, excluding AOCI and reportable catastrophe losses, for the year to date period. The company believes Operating ROE excluding AOCI and reportable catastrophe losses provides investors a valuable measure of the performance of the company’s ongoing business, because it excludes the effect of Assurant Health runoff operations, the divested Assurant Employee Benefits business, which was sold on March 1, 2016, and reportable catastrophe losses, which can be volatile. The calculation also excludes net realized gains (losses) on investments, amortization of deferred gains and gains on disposal of businesses and those events that are highly variable and do not represent the ongoing operations of the company. The comparable GAAP measure is GAAP return on equity (“GAAP ROE”), defined as net income, for the period presented, divided by average stockholders’ equity for the year to date period.

- Assurant uses net operating income as an important measure of the company’s operating performance. Net operating income equals net income excluding Assurant Health runoff operations, Assurant Employee Benefits, net realized gains (losses) on investments, amortization of deferred gains and gains on disposal of businesses and other highly variable items. The company believes net operating income provides a valuable measure of the performance of the company’s ongoing business because it excludes the effect of Assurant Health runoff operations and the divested Assurant Employee Benefits business, which the company sold on March 1, 2016. The calculation also excludes net realized gains (losses) on investments, amortization of deferred gains and gains on disposal of businesses and those events that are highly variable and do not represent the ongoing operations of the company. The comparable GAAP measure is net income.

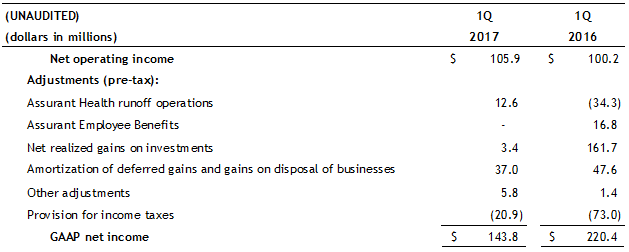

- Assurant uses Corporate & Other net operating loss as an important measure of the corporate segment’s operating performance. Corporate & Other net operating loss equals Total Corporate & Other segment net income, excluding Health runoff operations net income (loss), amortization of deferred gains and gains on disposal of businesses, net realized gains (losses) on investments, interest expense and other highly variable items. The company believes Corporate & Other net operating loss provides a valuable measure of the performance of the company’s corporate segment because it excludes the effect of amortization of deferred gains and gains on disposal of businesses, net realized gains (losses) on investments, interest expense and those events that are highly variable and do not represent the ongoing operations of the company’s corporate segment. The comparable GAAP measure is Total Corporate & Other segment net income.

- The company outlook for Corporate & Other full-year net operating loss constitutes forward-looking information and the company believes that it cannot reconcile such forward-looking information to the most comparable GAAP measure without unreasonable efforts. A reconciliation would require the company to quantify amortization of deferred gains and gains on disposal of businesses, interest expense, net realized gains on investments, and change in derivative investment. The last two components cannot be reliably quantified due to the combination of variability and volatility of such components and may, depending on the size of the components, have a significant impact on the reconciliation. The company is able to reasonably quantify the first two components for the forecast period, assuming the company does not incur additional debt in the forecast period. Amortization of deferred gains and gains on disposal of businesses is approximately $24.1 million after-tax while interest expense is approximately $8.2 million after-tax.

A summary of net operating income disclosed items is included on page 19 of the company’s Financial Supplement, which is available in the Investor Relations section of www.assurant.com.

Assurant, Inc.

Consolidated Statement of Operations (unaudited)

Three Months Ended March 31, 2017 and 2016

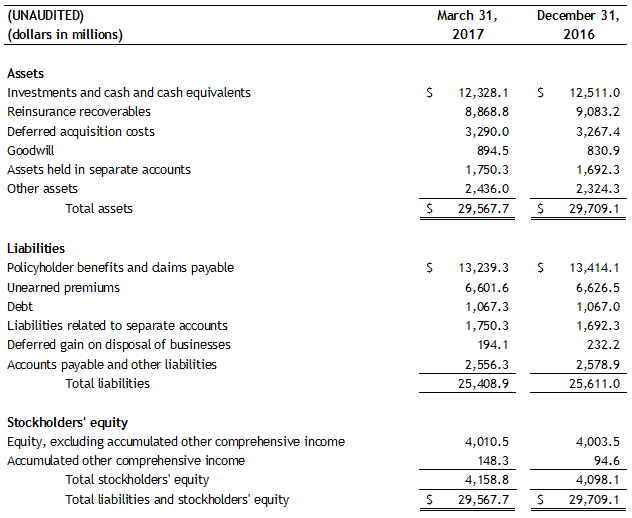

Assurant, Inc.

Consolidated Condensed Balance Sheets (unaudited)

At March 31, 2017 and Dec. 31, 2016