NEW YORK, December 22, 2016 — Assurant, Inc. (NYSE: AIZ) (the “Company”) today announced the total consideration payable in connection with its previously-announced cash tender offer (the “Offer”) for up to $100,000,000 aggregate principal amount (the “Tender Cap”) of its 6.750% Senior Notes due 2034 (the “Notes”), which commenced on December 9, 2016. The Offer will expire at 11:59 p.m., New York City time, on January 9, 2017 (such time and date, as the same may be extended, the “Expiration Date”). The terms and conditions of the Offer are described in the Offer to Purchase and the related Letter of Transmittal, each dated December 9, 2016 (the “Offer Documents”).

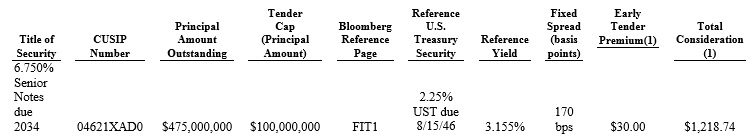

The table below sets forth the Total Consideration (as defined in the Offer Documents), which includes an early tender premium of $30.00 per $1,000 principal amount of the Notes accepted for purchase pursuant to the Offer (the “Early Tender Premium”). The reference yield listed in the table below is based on the bid-side price of the reference security listed in the table below at 2:00 p.m., New York City time, today, as described in the Offer Documents.

(1) Per $1,000 principal amount of Notes accepted for purchase. The Total Consideration, which includes the Early Tender Premium, will be paid to holders of Notes who tender, and do not validly withdraw, their Notes at or before 5:00 p.m., New York City time, on December 22, 2016 (the “Early Tender Deadline”), and whose Notes are accepted for purchase.

Only holders of Notes that validly tender and do not validly withdraw their Notes at or prior to Early Tender Deadline will be eligible to receive the applicable Total Consideration. Withdrawal rights for the Offer will expire at the Early Tender Deadline. Holders of Notes that are validly tendered after the Early Tender Deadline, but at or prior to the Expiration Date, and that are accepted for purchase will receive the tender consideration per $1,000 principal amount of Notes, which is equal to the Total Consideration minus the Early Tender Premium. Holders will also receive accrued and unpaid interest on Notes validly tendered and accepted for purchase from the last interest payment date up to, but not including, the date the Company makes payment for such Notes. The Company anticipates making such payment with respect to Notes tendered prior to the Early Tender Deadline and accepted for payment on December 23, 2016.

The Company reserves the absolute right, subject to applicable law, to: (i) waive any or all conditions to the Offer; (ii) extend, terminate or withdraw the Offer; (iii) increase, decrease or eliminate the Tender Cap; or (iv) otherwise amend the Offer in any respect.

Wells Fargo Securities, LLC is acting as the dealer manager for the Offer. The information agent and tender agent for the Offer is Global Bondholder Services Corp. Copies of the Offer Documents and related offering materials are available by contacting Global Bondholder Services Corp. at (866) 470-4500) (toll-free) or (212) 430-3774 (banks and brokers). Questions regarding the Offer should be directed to Wells Fargo Securities, LLC, at (704) 410-4760 (collect) or (866) 309-6316 (toll free).

This press release shall not constitute an offer to sell, a solicitation to buy or an offer to purchase or sell any securities. The Offer is being made only pursuant to the Offer Documents and only in such jurisdictions as is permitted under applicable law.

About Assurant, Inc.

Assurant, Inc. (NYSE: AIZ) is a global provider of risk management solutions, protecting where consumers live and the goods they buy. A Fortune 500 company, Assurant focuses on the housing and lifestyle markets, and is among the market leaders in mobile device protection; extended service contracts; vehicle protection; pre-funded funeral insurance; renters insurance; lender-placed homeowners insurance; and mortgage valuation and field services. With approximately $30 billion in assets and $6 billion in annualized revenue as of Sept. 30, 2016, Assurant is located in 16 countries, while its Assurant Foundation works to support and improve communities. Learn more at assurant.com or on Twitter @AssurantNews.

Cautionary Statement Regarding Forward-Looking Statements

Some statements set forth in this communication are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these statements by the use of words such as “will,” “may,” “anticipates,” “expects,” “estimates,” “projects,” “intends,” “plans,” “believes,” “targets,” “forecasts,” “potential,” “approximately,” or the negative version of those words and other words and terms with a similar meaning. Any forward-looking statements contained or incorporated by reference in this communication are based upon our historical performance and on current plans, estimates and expectations. The inclusion of this forward looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. Our actual results might differ materially from those projected in the forward-looking statements. The Company undertakes no obligation to update or review any forward-looking statement, whether as a result of new information, future events or other developments.

For a detailed discussion of the risk factors that could affect our actual results, please refer to “Critical Factors Affecting Results” in Item 7 and “Risk Factors” in Item 1A of our Form 10-K for the year ended December 31. 2015 and Item 2 of our Form 10-Q for the quarter ended September 30, 2016.

Further, it is not possible to assess the effect of all risk factors on our businesses or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. In addition, except as required by law, we disclaim any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

# # #

Media Contact:

Linda Recupero

Senior Vice President, Global Communication

Phone: 212.859.7005

[email protected]

Investor Relations Contact:

Suzanne Shepherd

Vice President, Investor Relations

Phone: 212.859.7062

[email protected]