Safeguards 2.4 Million Property Insurance Policyholders Covered by Assurant

NEW YORK, July 7, 2014 -- Assurant, Inc. (NYSE: AIZ), a premier provider of specialized insurance and insurance-related products and services, finalized the company’s 2014 Property Catastrophe Reinsurance Program to help safeguard more than 2.4 million property insurance policyholders in the event of damage from severe storms.

Assurant’s program provides more than $1.8 billion in coverage to preserve the company’s financial position and ensures the ability to pay claims to homeowners from catastrophic losses caused by hurricanes, tornados or other significant weather events.

“Our catastrophe reinsurance program ensures that Assurant is able to meet its commitment to protect policyholders when disasters strike,” said Gene Mergelmeyer, president and CEO, Assurant Specialty Property. “The comprehensive 2014 program expands upon our multi-year, multiple-event coverage, takes advantage of favorable rates, and ensures we are ready to assist our customers and clients when devastating weather events occur.”

Assurant placed its traditional catastrophe program in two phases, in January and June 2014, with more than 50 reinsurers rated A- or better by A.M. Best. The company supplements the traditional 2014 per-occurrence program through reinsurers, with multi-year fully collateralized coverage, financed with catastrophe bonds to further diversify sources of reinsurance capacity.

Multiple factors are considered in evaluating the size and components of Assurant’s reinsurance program including:

- Estimated claims loss potential from various perils

- Cost efficiency of the reinsurance coverage available

- Assurant’s financial strength, and

- Claims paying ability of the reinsurers in the program.

2014 Coverage Enhancements and Comprehensive Risk Management Components

The 2014 Property Catastrophe Reinsurance Program includes key enhancements:

- Reduction in Assurant’s retention, or risk retained by the company, to $190 million in 2014 from $240 million in 2013 through:

- Expanded multiple-storm coverage, providing $50 million of first-event coverage in excess of a $190 million retention.

- Increased multi-year coverage, providing a $342 million limit for multi-year coverage in addition to the previously issued Ibis Re II Ltd. catastrophe bonds. This was placed to further enhance Assurant's long-term protection from catastrophic perils.

Other risk management components include:

- Per-occurrence catastrophe coverage, providing protection of up to $1.8 billion in excess of a $190 million retention. The coverage is structured in several layers and placed 100 percent through traditional reinsurance and catastrophe bonds.

- Catastrophe bonds, providing $315 million of multi-year, fully collateralized hurricane coverage ($130 million issued in January 2012 and $185 million issued in June 2013 by Ibis Re II Ltd). The reinsurance purchased in 2013 from Ibis Re II Ltd. consists of three separate layers of coverage for protection against losses from individual hurricane events, including catastrophe prone areas along the Gulf and East coasts of the United States, Hawaii and Puerto Rico.

- Florida Hurricane Catastrophe Fund (FHCF) coverage1, providing Florida-specific coverage for 90 percent of losses up to $494 million in excess of a $181 million retention.

An illustration of the 2014 Assurant catastrophe program's layered structure is available in the Newsroom section of www.assurant.com.

Financial Comparison of Program

In the event of Florida hurricanes, Assurant’s catastrophe program for per-occurrence coverage is net of any reimbursements from the FHCF. Traditional reinsurance is the only portion of the program that provides for an automatic reinstatement of coverage for a second occurrence. There is additional per-occurrence coverage of $105 million in excess of a $25 million retention for the Caribbean and $256 million in excess of a $9 million retention for Latin America.

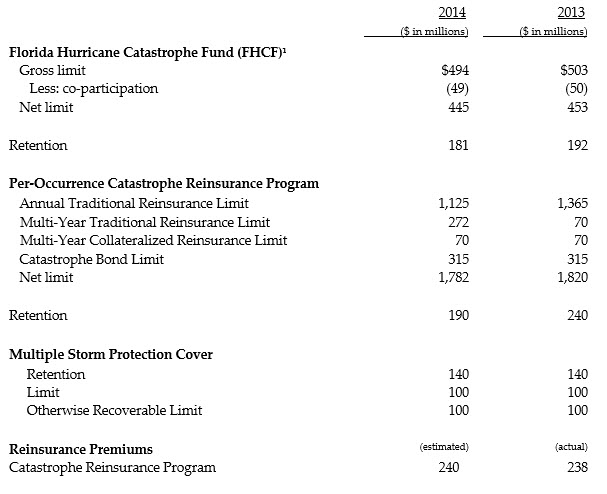

Base reinsurance premiums for the entire catastrophe program, which reduce gross earned premiums, are estimated to be $240 million in 2014, compared with $238 million in 2013. Actual reinsurance premiums will vary if exposure growth changes significantly from estimates or if reinstatement premiums are required due to reportable catastrophe events.

A comparison of the reinsurance retentions, limits and premiums for the prior and current programs is shown below2.

About Assurant

Assurant is a premier provider of specialized insurance products and related services in North America and select worldwide markets. Its four key businesses -- Assurant Solutions, Assurant Specialty Property, Assurant Health, and Assurant Employee Benefits -- partner with clients who are leaders in their industries and build leadership positions in a number of specialty insurance market segments worldwide.

Assurant, a Fortune 500 company and a member of the S&P 500, is traded on the New York Stock Exchange under the symbol AIZ. Assurant has approximately $30 billion in assets and $9 billion in annual revenue. For more information on Assurant, please visit www.assurant.com and follow us on Twitter @AssurantNews.

Safe Harbor Statement:

Some of the statements included in this press release, particularly those regarding coverage under our 2014 Property Catastrophe Reinsurance Program or the expected financial effects of this program on the company, may be forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Our actual results may differ materially from those projected in any forward-looking statements. Assurant undertakes no obligation to update any forward-looking statements in this news release as a result of new information or future events or developments. For a discussion of the factors that could affect our actual results please refer to the risk factors identified from time to time in our SEC reports, including but not limited to our 2013 Annual Report on Form 10-K, as filed with the SEC.

Media Contact:

Vera Carley

Assistant Vice President, External Communication

Phone: 212.859.7002

[email protected]

Investor Relations Contact:

Suzanne Shepherd

Director, Investor Relations

Phone: 212.859.7062

[email protected]

_________________________________

1 2014 Florida Hurricane Catastrophe Fund limits and retention are estimated based on Florida exposure projected as of June 30, 2014.

2 2014 retention, limits and reinsurance premiums are estimated and can change with growth of the business. Certain 2013 estimates have been updated to reflect actual amounts.