2Q 2012 Net Operating Income of $157.4 million, $1.81 per diluted share

2Q 2012 Net Income of $169.2 million, $1.94 per diluted share

NEW YORK, July 25, 2012—Assurant, Inc. (NYSE: AIZ), a premier provider of specialty insurance and insurance-related products and services, today reported results for the second quarter ended June 30, 2012.

"Assurant's disciplined actions are generating solid results as we focus on areas targeted for profitable growth," said Robert B. Pollock, president and CEO of Assurant. "We are meeting the challenges of today's marketplace as we provide outstanding service for consumers and clients alike while creating long-term value for our shareholders."

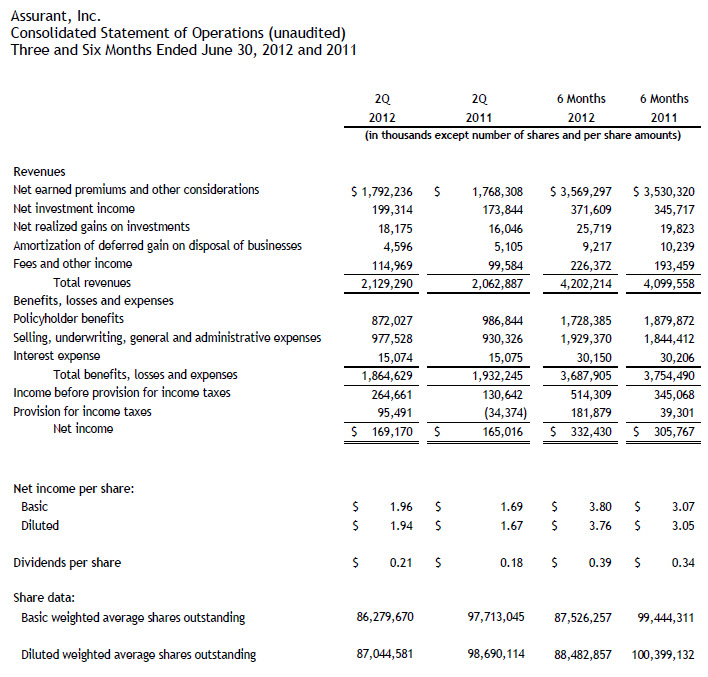

Second Quarter 2012 Consolidated Results

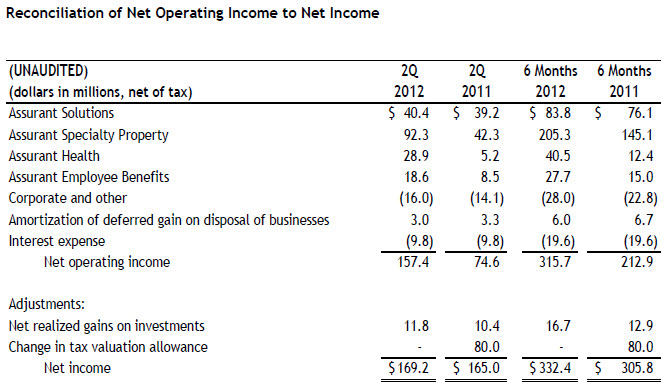

- Net operating income1 more than doubled to $157.4 million, or $1.81 per diluted share, compared to second quarter 2011 net operating income of $74.6 million, or $0.76 per diluted share, primarily due to improved results at Assurant Specialty Property, Assurant Health and Assurant Employee Benefits. Income from real estate joint venture partnerships contributed $19.3 million after-tax to results.

- Net income increased to $169.2 million, or $1.94 per diluted share, compared to second quarter 2011 net income of $165.0 million, or $1.67 per diluted share. Second quarter 2011 net income benefited from an $80.0 million reduction in a valuation allowance associated with deferred tax assets.

- Net earned premiums, fees and other income were $1.9 billion, up 2 percent compared to second quarter 2011, reflecting improvement in areas targeted for growth.

- Net investment income increased to $199.3 million, compared to $173.8 million in second quarter 2011. Results included $29.8 million of income from real estate joint venture partnerships.

Note: Additional financial information, including a schedule of disclosed items that affected Assurant's results by business for the last six quarters (page 20), is available in the Company's Financial Supplement, located in the Investor Relations section of www.assurant.com.

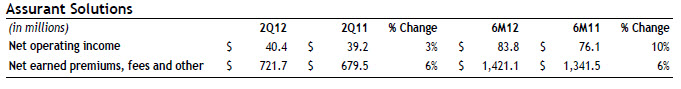

- Net operating income in second quarter 2012 increased due to $3.8 million of after-tax income from client-related settlements and $1.6 million of income from real estate joint venture partnerships. Results were adversely affected by increased expenses associated with business growth.

- Net earned premiums, fees and other income increased in second quarter 2012. Domestic premiums increased in the quarter reflecting service contract growth in the retail and automotive markets from both new and existing clients. International premiums increased from growth in retail service contracts, mobile and credit insurance from new and existing clients in Latin America. Fee income increased from preneed sales as well as service contracts.

- Gross written premiums and face sales increased in second quarter 2012 primarily due to growth in domestic service contracts, European service contracts and preneed sales. Domestic results also reflected premium growth from new and existing automotive and retail clients. Preneed sales increased in the U.S. and Canada.

- Domestic combined ratio for the quarter increased to 97.9 percent, compared to 96.6 percent in the second quarter 2011, due to increased expenses associated with business growth.

- International combined ratio for the quarter decreased to 101.1 percent from 104.3 in the second quarter 2011, reflecting the favorable $5.7 million of pre-tax income from client-related settlements.

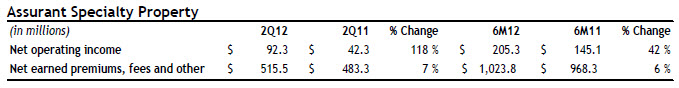

- Net operating income increased in second quarter 2012 due to lower reportable catastrophe losses of $9.8 million after-tax, compared to $42.7 million after-tax in second quarter 2011. Growth in loan portfolios from new and existing clients in lender-placed homeowners and multi-family housing products, along with $1.9 million of income from real estate joint venture partnerships also contributed to the increase.

- Net earned premiums, fees and other income increased in the quarter primarily due to growth in lender-placed loan portfolios and multi-family housing products, including increased fees from the SureDeposit acquisition in 2011. Lender-placed homeowners premiums increased, reflecting higher insurance placements and an increased number of tracked loans.

- Combined ratio improved to 78.2 percent compared to 92.1 percent in second quarter 2011, reflecting lower reportable catastrophe losses and lower loss frequency of non-catastrophe weather-related activity.

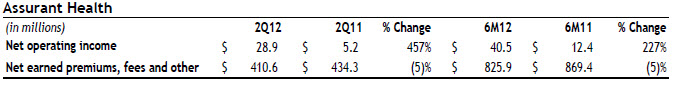

- Net operating income increased in second quarter 2012. Results included $13.9 million of income from real estate joint venture partnerships. Lower expenses and favorable loss experience also contributed to the improvement.

- Net earned premiums, fees and other income decreased for the quarter due to lower sales in traditional individual medical and small group business. Improved supplemental and affordable choice product sales partially offset the decline.

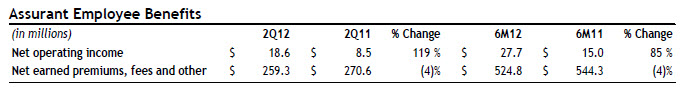

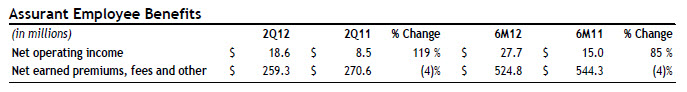

- Net operating income increased in second quarter 2012 due to favorable loss experience across all major product lines, particularly in disability. Results included $1.9 million of income from real estate joint venture partnerships.

- Net earned premiums, fees and other income declined in second quarter 2012, reflecting the previously disclosed loss of two disability clients. Voluntary insurance premiums, an area targeted for growth, increased compared to second quarter 2011.

- Sales decreased for the quarter. A decline in life and disability products sales drove the decrease. Improved voluntary product sales partially offset the decline and accounted for more than half of all sales.

- Net operating loss increased for the quarter primarily due to higher tax expenses.

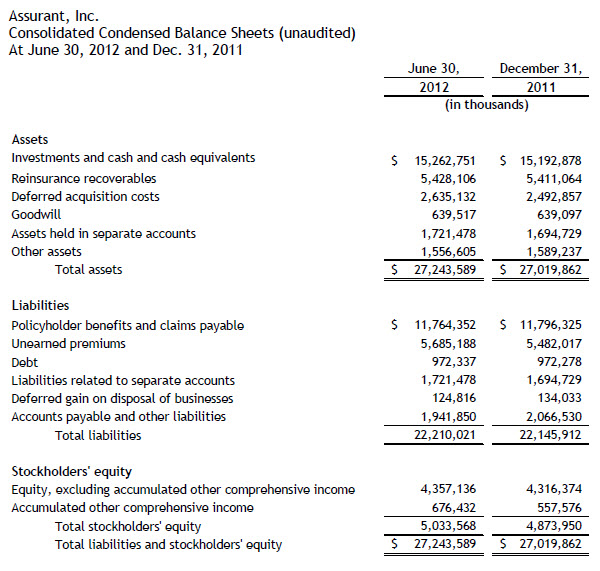

Capital Position

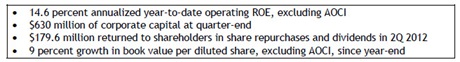

- Corporate capital stood at approximately $630 million as of June 30, 2012. Excluding a $250 million risk buffer, deployable capital totaled approximately $380 million as of June 30, 2012. Year-to-date, approximately $240 million has been paid by the business segments as dividends to the holding company.

- Share repurchases and dividends totaled $179.6 million for second quarter 2012. Assurant repurchased 4.6 million shares of its common stock for $160.2 million during the quarter. Through July 20, 2012, the Company repurchased an additional 1.4 million shares for $46.7 million, and has $601.6 million remaining in repurchase authorization. The Company also raised its quarterly dividend to $0.21 from $0.18 per common share during the quarter.

Financial Position

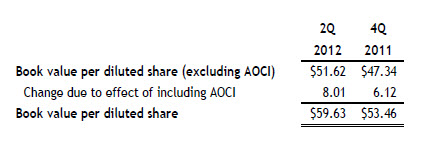

- Stockholders' equity, excluding accumulated other comprehensive income (AOCI), was $4.4 billion at June 30, 2012, up $41 million from Dec. 31, 2011.

- Book value per diluted share2, excluding AOCI, increased 9 percent to $51.62 from $47.34 at Dec. 31, 2011. AOCI increased $118.9 million to $676.4 million as of June 30, 2012.

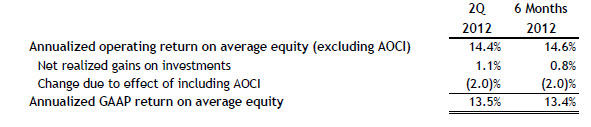

- Annualized operating return on average equity (ROE)3, excluding AOCI, was 14.6 percent for the first six months of 2012 compared to full-year operating ROE, excluding AOCI, of 10.1 percent in 2011.

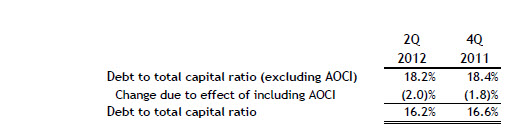

- Total assets as of June 30, 2012 were approximately $27.2 billion. The ratio of debt to total capital4, excluding AOCI, declined to 18.2 percent at June 30, 2012 from 18.4 percent at Dec. 31, 2011, while the ratio of invested assets to equity decreased to 2.8 compared to 2.9 at Dec. 31, 2011.

Other Items

- As previously disclosed, the Company adopted amendments to existing guidance on accounting for deferred acquisition costs on Jan. 1, 2012. This guidance was adopted retrospectively and has been applied to all prior financial information. As of Jan. 1, 2012, beginning stockholders' equity was reduced by approximately $153 million, or 3 percent. The equity adjustment was non-cash and affected only GAAP financial statements.

Company Outlook

Based on current market conditions for full-year 2012, the Company now expects:

- Assurant Specialty Property's net earned premiums and fees to modestly increase compared to 2011, reflecting growth in multi-family housing and new loan portfolios added by our clients. Expense and non-catastrophe loss ratios to trend up as a result of a changing product mix.

Consistent with the first quarter 2012 outlook and based on current market conditions for full-year 2012, the Company continues to expect:

- Assurant Solutions to achieve modest growth in net earned premiums and fees, reflecting increased sales of both international and domestic service contracts. The international full-year 2012 combined ratio to improve 100 to 200 basis points compared to the 104.0 percent reported in 2011. The domestic combined ratio to remain near the 98 percent target.

- Assurant Health's overall business results, excluding non-recurring items, to improve from 2011 due to favorable loss experience from product mix changes and continued expense savings. Sales of affordable and supplemental products to increase and expense reductions to continue. Major medical product sales to improve in second half 2012 from the implementation of new provider network contract with Aetna Signature Administrators®.

- Assurant Employee Benefits to continue growing voluntary and supplemental product net earned premiums. Overall premiums to be lower primarily due to a $40 million reduction in premiums from the previously disclosed loss of two disability clients.

- Corporate & Other full-year 2012 net operating loss to be $60-$65 million due to additional investment in areas targeted for growth.

- Capital Deployment to enhance risk-adjusted returns through continued share repurchases, shareholder dividends and selective investments in growth. All operating income from the business segments to be available for dividends to Corporate by year-end 2012.

Earnings Conference Call

- The second quarter 2012 earnings conference call and webcast will be held on Thurs., July 26, 2012 at 8:00 a.m. ET. The live and archived webcast along with supplemental information also will be available in the Investor Relations section of www.assurant.com.

About Assurant

Assurant is a premier provider of specialized insurance products and related services in North America and select worldwide markets. The four key businesses -- Assurant Solutions, Assurant Specialty Property, Assurant Health and Assurant Employee Benefits -- partner with clients who are leaders in their industries and build leadership positions in a number of specialty insurance market segments. Assurant provides debt protection administration; credit-related insurance; warranties and service contracts; pre-funded funeral insurance; solar project insurance; lender-placed homeowners insurance; manufactured housing homeowners insurance; individual health and small employer group health insurance; group dental insurance; group disability insurance; and group life insurance.

Assurant, a Fortune 500 company and a member of the S&P 500, is traded on the New York Stock Exchange under the symbol AIZ. Assurant has approximately $27 billion in assets and $8 billion in annual revenue. Assurant has approximately 14,000 employees worldwide and is headquartered in New York's financial district. www.assurant.com.

| Media Contact: | Investor Relations Contacts: | |

| Vera Carley | Melissa Kivett | Suzanne Shepherd |

| Director, Media Relations and | Senior Vice President | Director |

| Financial Communications | Investor Relations | Investor Relations |

| Phone: 212-859-7002 | Phone: 212-859-7029 | Phone: 212-859-7062 |

| [email protected] | [email protected] | [email protected] |

Safe Harbor Statement

Some of the statements included in this news release and its exhibits, particularly those anticipating future financial performance, business prospects, growth and operating strategies and similar matters, are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these statements by the fact that they may use words such as "will," "anticipate," "expect," "estimate," "project," "intend," "plan," "believe," "target," "forecast," or the negative versions of those words and terms with a similar meaning. Our actual results may differ materially from those projected in the forward-looking statements. The Company undertakes no obligation to update any forward-looking statements in this earnings release or the exhibits as a result of new information or future events or developments.

The following risk factors could cause our actual results to differ materially from those currently estimated by management, including those projected in the Company outlook:

(i) the effects of the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010, and the rules and regulations thereunder, on our health and employee benefits businesses;

(ii) actions by governmental agencies or government sponsored entities or other circumstances, including pending regulatory matters affecting the lender-placed insurance business, that could require us to reduce premium rates or result in increases in the claims we pay or in other expenses;

(iii) loss of significant client relationships, distribution sources and contracts;

(iv) failure to attract and retain sales representatives;

(v) losses due to natural and man-made catastrophes;

(vi) a decline in our credit or financial strength ratings (including the risk of ratings downgrades in the insurance industry);

(vii) deterioration in the Company's market capitalization compared to its book value that could result in further impairment of goodwill;

(viii) unfavorable outcomes in litigation and/or regulatory investigations that could negatively affect our business and reputation;

(ix) current or new laws and regulations that could increase our costs and decrease our revenues;

(x) general global economic, financial market and political conditions (including difficult conditions in financial, capital and credit markets, the global economic slowdown, fluctuations in interest rates, monetary policies, unemployment and inflationary pressure);

(xi) inadequacy of reserves established for future claims;

(xii) failure to predict or manage benefits, claims and other costs;

(xiii) uncertain tax positions;

(xiv) fluctuations in exchange rates and other risks related to our international operations;

(xv) unavailability, inadequacy and unaffordable pricing of reinsurance coverage;

(xvi) diminished value of invested assets in our investment portfolio (due to, among other things, volatility in financial markets, the global economic slowdown, credit and liquidity risk, other than temporary impairments and increases in interest rates);

(xvii) insolvency of third parties to whom we have sold or may sell businesses through reinsurance or modified co-insurance;

(xviii) inability of reinsurers to meet their obligations;

(xix) credit risk of some of our agents in Assurant Specialty Property and Assurant Solutions;

(xx) failure to effectively maintain and modernize our information systems and protect them from cyber-security threats;

(xxi) risks related to outsourcing activities;

(xxii) failure to protect client information and privacy;

(xxiii) failure to find and integrate suitable acquisitions and new ventures;

(xxiv) inability of our subsidiaries to pay sufficient dividends;

(xxv) failure to provide for succession of senior management and key executives;

(xxvi) significant competitive pressures in our businesses; and

(xxvii) cyclicality of the insurance industry.

For a detailed discussion of the risk factors that could affect our actual results, please refer to the risk factors identified in our SEC reports, including, but not limited to, our 2011 Annual Report on Form 10-K, as filed with the SEC.

Non-GAAP Financial Measures

Assurant uses the following non-GAAP financial measures to analyze the Company's operating performance for the periods presented in this news release. Because Assurant's calculation of these measures may differ from similar measures used by other companies, investors should be careful when comparing Assurant's non-GAAP financial measures to those of other companies.

(1) Assurant uses net operating income as an important measure of the Company's operating performance. As shown in the net operating income reconciliation table, net operating income equals net income, excluding net realized gains (losses) on investments and other unusual and/or infrequent items. The Company believes net operating income provides investors a valuable measure of the performance of the Company's ongoing business, because it excludes both the effect of net realized gains (losses) on investments that tend to be highly variable from period to period, and those events that are unusual and/or unlikely to recur.

(2) Assurant uses book value per diluted share excluding AOCI, as an important measure of the Company's stockholder value. Book value per diluted share excluding AOCI equals total stockholders' equity excluding AOCI divided by diluted shares outstanding. The Company believes book value per diluted share excluding AOCI provides investors a valuable measure of stockholder value because it excludes the effect of unrealized gains (losses) on investments, which tend to be highly variable from period to period and other AOCI items. The comparable GAAP measure would be book value per diluted share, defined as total stockholders' equity divided by diluted shares outstanding. Book value per diluted share was $59.63 and $53.46 as of June 30, 2012 and Dec. 31, 2011, respectively, as shown in the reconciliation table below.

(3) Assurant uses annualized operating ROE, excluding AOCI, as an important measure of the Company's operating performance. Annualized operating ROE equals net operating income for the periods presented divided by average stockholders' equity for the year-to-date period, excluding AOCI, and then the return is annualized, if necessary. The Company believes annualized operating ROE, excluding AOCI, provides investors a valuable measure of the performance of the Company's ongoing business, because it excludes the effect of net realized gains (losses) on investments that tend to be highly variable from period-to-period, AOCI items and those events that are unusual and/or unlikely to recur. The comparable GAAP measure would be annualized GAAP ROE, defined as net income, for the period presented, divided by average stockholders' equity for the period and then the return is annualized, if necessary. Consolidated annualized GAAP ROE for the three and six months ended June 30, 2012 was 13.5 percent and 13.4 percent, respectively, as shown in the following reconciliation table.

(4) Assurant uses a ratio of debt to total capital, excluding AOCI, as an important measure of the Company's financial leverage. Assurant's debt to total capital ratio, excluding AOCI, equals debt (which would include mandatorily redeemable preferred stock, if any) divided by the sum of debt and total stockholders' equity excluding AOCI. The Company believes that the debt to total capital ratio, excluding AOCI, provides investors a valuable measure of financial leverage, because it excludes the effect of unrealized gains (losses) on investments, which tend to be highly variable from period to period, and other AOCI items. The comparable GAAP measure would be the ratio of debt to total capital. The debt to total capital ratio as of June 30, 2012 and Dec. 31, 2011 was 16.2 percent and 16.6 percent, respectively, as shown in the following reconciliation table.

A summary of net operating income disclosed items is included on page 20 of the Company's Financial Supplement, which is available in the Investor Relations section of www.assurant.com.