NEW YORK, Sept. 17, 2008 -- Assurant, Inc. ("Assurant") (NYSE: AIZ), a premier provider of specialty insurance and insurance-related products and services, today released an estimate of losses resulting from hurricanes Gustav and Ike as well as the impact of the recent financial market developments on certain holdings within its investment portfolio.

Robert B. Pollock, Assurant's president and chief executive officer, said: "While Assurant has not been immune to the recent turmoil befalling the U.S. financial markets or an active hurricane season, we continue to have a solid balance sheet, a strong excess capital position, a conservative disciplined investment philosophy and a unique specialty business model that will continue to deliver long term value to our shareholders."

Hurricane Experience

To date, Assurant has incurred paid and case reserves of approximately $21 million on hurricane Gustav, and estimates total claims to be in the range of $40 to $60 million. The Company anticipates claims generated by hurricane Ike will likely reach the Company's $95 million retention limit, at which time the Company's catastrophe reinsurance program will take effect. The Company expects that claims from hurricane Ike will fall well within its reinsurance coverage limits, which would cover a $770 million catastrophe event. As part of the current catastrophic reinsurance program, the Company has an automatic reinstatement for a second event under terms similar to the current program.

Investment Portfolio

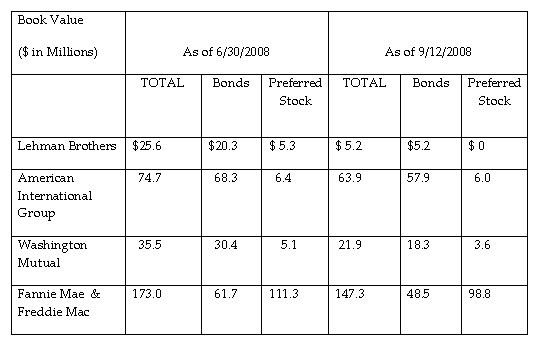

Amid the recent and dramatic changes within the financial markets, Assurant has realized approximately $42.5 million gross pre-tax investment losses since the second quarter close as it has repositioned portions of the investment portfolio in response to market events. Assurant expects to record other than temporary impairments for the third quarter, subject to the Company's quarterly impairment review. The Company anticipates that the impairments will be concentrated primarily in preferred stock holdings, and will include but not be limited to those listed in the table below. Total preferred stock investments at the end of the second quarter 2008 were approximately $750 million on a book value basis, which represented only 5% of the $14 billion investment portfolio.

Listed in the table below, are investments at book value of select financial companies within the Company's investment portfolio. These represent bond and preferred stock holdings as the Company owns no common equity in these companies. In the unlikely event that there is no recovery from all of these investments, the estimated impact would result in a $1.40 reduction in Assurant's pro forma book value per share. In summary, the investments listed below represent less than 2% of the Company's diversified investment portfolio.

Table of Select Financial Companies in the News

Safe Harbor Statement:

Some of the statements included in this press release particularly those anticipating future financial performance, business prospects, growth and operating strategies and similar matters, are forward-looking statements that involve a number of risks and uncertainties. You can identify these statements by the fact that they may use words such as "will," "anticipate," "expect," "estimate," "project," "intend," "plan," "believe," "target," "forecast," or the negative versions of those words and terms with a similar meaning. Our actual results might differ materially from those projected in the forward-looking statements. The Company undertakes no obligation to update any forward-looking statements in this press release as a result of new information or future events or developments.

The following risk factors could cause our actual results to differ materially from those currently estimated by management: (i) failure to maintain significant client relationships, distribution sources and contractual arrangements; (ii) failure to attract and retain sales representatives; (iii) general global economic, financial market and political conditions (including fluctuations in interest rates, mortgage rates, monetary policies and inflationary pressure); (iv) inadequacy of reserves established for future claims losses; (v) failure to predict or manage benefits, claims and other costs; (vi) diminished value of invested assets in our investment portfolio (due to, among other things, credit and liquidity risk, environmental liability exposure and inability to target an appropriate overall risk level); (vii) losses due to natural and man-made catastrophes; (viii) unavailability, inadequacy and unaffordable pricing of reinsurance coverage; (ix) inability of reinsurers to meet their obligations; (x) insolvency of third parties to whom we have sold or may sell businesses through reinsurance or modified co-insurance; (xi) credit risk of some of our agents in Assurant Specialty Property and Solutions; (xii) a further decline in the manufactured housing industry; (xiii) a decline in our credit or financial strength ratings; (xiv) failure to effectively maintain and modernize our information systems; (xv) failure to protect client information and privacy; (xvi) failure to find and integrate suitable acquisitions and new insurance ventures; (xvii) inability of our subsidiaries to pay sufficient dividends; (xviii) failure to provide for succession of senior management and key executives; (xix) negative publicity and impact on our business due to unfavorable outcomes in litigation and regulatory investigations (including the potential impact on our reputation and business of a negative outcome in the ongoing SEC investigation); (xx) significant competitive pressures in our businesses and cyclicality of the insurance industry: (xxi) current or new laws and regulations that could increase our costs or limit our growth in Assurant Specialty Property and Solutions; (xii) a further decline in the manufactured housing industry; (xiii) a decline in our credit or financial strength ratings; (xiv) failure to effectively maintain and modernize our information systems; (xv) failure to protect client information and privacy; (xvi) failure to find and integrate suitable acquisitions and new insurance ventures; (xvii) inability of our subsidiaries to pay sufficient dividends; (xviii) failure to provide for succession of senior management and key executives; (xix) negative publicity and impact on our business due to unfavorable outcomes in litigation and regulatory investigations (including the potential impact on our reputation and business of a negative outcome in the ongoing SEC investigation); (xx) significant competitive pressures in our businesses and cyclicality of the insurance industry: (xxi) current or new laws and regulations that could increase our costs or limit our growth.

For a detailed discussion of the risk factors that could affect our actual results, please refer to the risk factors identified in our SEC reports, including, but not limited to, our 2007 Annual Report on 10-K, as filed with the SEC.

Assurant is a premier provider of specialized insurance products and related services in North America and selected international markets. Its four key businesses -- Assurant Solutions, Assurant Specialty Property, Assurant Health and Assurant Employee Benefits -- have partnered with clients who are leaders in their industries and have built leadership positions in a number of specialty insurance market segments worldwide.

Assurant, a Fortune 500 company and a member of the S&P 500, is traded on the New York Stock Exchange under the symbol AIZ. Assurant has more than $26 billion in assets and $8 billion in annual revenue. Assurant has approximately 14,000 employees worldwide and is headquartered in New York's financial district. www.assurant.com.

Press Contact:

Drew Guthrie

Manager, Communications

and Media Relations

Phone: 212-859-7002

Fax: 212-859-5893

[email protected]

Investor Relations:

Melissa Kivett

Vice President

Investor Relations

Phone: 212-859-7029

Fax: 212-859-5893

[email protected]

John Egan

Vice President

Investor Relations

Phone: 212-859-7197

Fax: 212-859-5893

[email protected]