Q4 2007 Net Operating Income of $154.4 Million ($1.29 per diluted share), Up 13%; Full Year Net Operating Income of $694.2 Million ($5.72 per diluted share), Up 15%

Q4 2007 Net Income of $120.8 Million ($1.01 per diluted share) and $653.7 Million ($5.38 per diluted share) for Full Year 2007

NEW YORK, February 7, 2008—Assurant, Inc. ("Assurant") (NYSE: AIZ), a premier provider of specialized insurance and insurance-related products and services, today reported its results for the fourth quarter of 2007 and the twelve months ended December 31, 2007.

Robert B. Pollock, Assurant's president and chief executive officer, said: "Assurant's performance for the quarter and year illustrates our steady execution of our diversified specialty insurance strategy despite the beginning of a slowdown in the economy. We continue to deliver growth in both net operating income and book value per share while producing top quartile return on equity. We believe this strategy has us well positioned for 2008 despite uncertainties in the economy."

Fourth Quarter Results

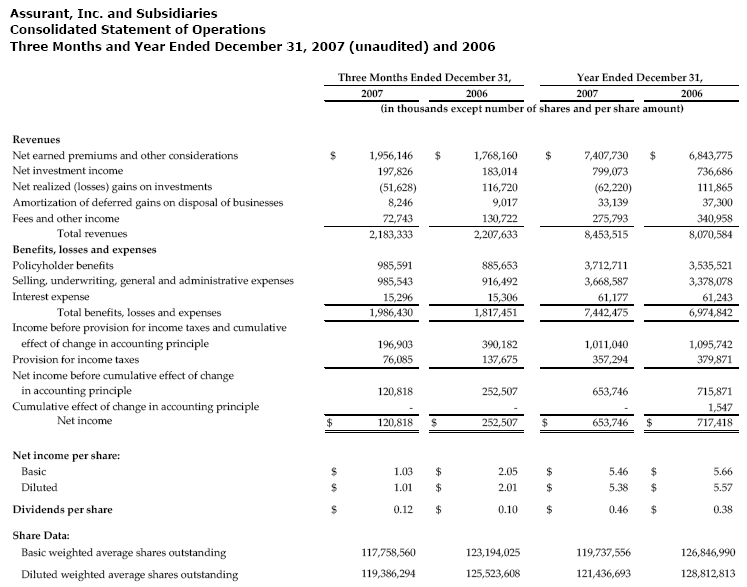

Net operating income (see footnote 1 at the end of this release) for the fourth quarter of 2007 increased 13% to $154.4 million, or $1.29 per diluted share, compared to fourth quarter 2006 net operating income of $136.2 million, or $1.08 per diluted share.

Net income in the fourth quarter of 2007 decreased 52% to $120.8 million, or $1.01 per diluted share, compared to fourth quarter 2006 net income of $252.5 million, or $2.01 per diluted share. Net income in the fourth quarter of 2007 includes $27.0 million of after-tax realized losses from other than temporary impairments in the investment portfolio. Net income in the fourth quarter of 2006 includes a $63.9 million after-tax gain from the sale of Assurant's interest in a PPO network, Private Healthcare Systems, Inc. (PHCS) and $40.5 million of after-tax income from a favorable Assurant Solutions legal settlement.

Net earned premiums of $1.96 billion in the fourth quarter of 2007 increased 11% from $1.77 billion in the fourth quarter of 2006, driven mostly by growth in Assurant Specialty Property and Assurant Solutions.

Net investment income in the fourth quarter of 2007 increased 8% to $197.8 million from $183.0 million in the fourth quarter of 2006 primarily as a result of an increase in average invested assets.

Twelve-Month Results

Net operating income in 2007 was $694.2 million, or $5.72 per diluted share, an increase of 15% compared to net operating income of $602.7 million, or $4.68 per diluted share, in 2006. Net operating income excludes capital gains and losses and other unusual or non-recurring items.

Net income in 2007 was $653.7 million, or $5.38 per diluted share, a decrease of 9%, compared to net income of $717.4 million, or $5.57 per diluted share, in 2006. Net income in 2007 includes $31.3 million of after-tax realized losses from other than temporary impairments in the investment portfolio. Net income in 2006 includes a $63.9 million after-tax gain from the sale of PHCS as well as $40.5 million of after-tax income from a favorable Assurant Solutions legal settlement.

Net earned premiums in 2007 were $7.41 billion, an increase of 8% from $6.84 billion in 2006. Growth in net earned premiums was driven mainly by growth in Assurant Specialty Property.

Net investment income in 2007 increased 8% to $799.1 million from $736.7 million in 2006 primarily resulting from an increase in average invested assets and $37.2 million of investment income from real estate joint venture partnerships compared with $18.6 million in 2006.

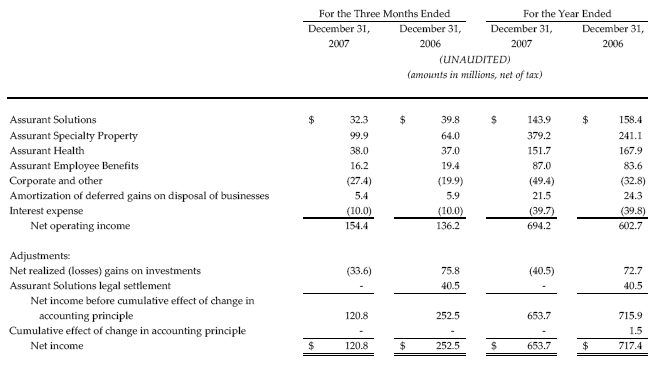

The following chart provides a reconciliation of net operating income to net income for Assurant:

Assurant Solutions

Assurant Solutions fourth quarter 2007 net operating income was $32.3 million, a 19% decrease from fourth quarter 2006 net operating income of $39.8 million. Results for the quarter were negatively impacted by $3.4 million after-tax from a client-related settlement and benefited by $3.8 million after-tax from a client commission reconciliation project, which has been completed. Net operating income for the full year was $143.9 million, a 9% decrease from 2006 net operating income of $158.4 million. Results for the quarter and year declined primarily due to higher domestic and international combined ratios. Domestic results were impacted by less favorable service contract loss experience and the previously disclosed loss of a debt deferment client in late 2006. The international business was impacted by its continued investments made to support its strategic expansion and modest increases in overall expenses.

Assurant Solutions fourth quarter 2007 net earned premiums increased 10% to $678.8 million from $617.8 million in the fourth quarter of 2006. Net earned premiums in 2007 increased 7% to $2.53 billion from $2.37 billion in 2006. Increases for the quarter and year were primarily driven by continued growth in domestic and international service contracts as well as growth in preneed premiums from the acquisition of Mayflower National Life Insurance Company during the third quarter of 2007. The increases were partially offset by declines in domestic credit insurance for the fourth quarter and full year 2007, which continues to diminish consistent with our long term expectations.

Assurant Specialty Property

Assurant Specialty Property fourth quarter 2007 net operating income was $99.9 million, up 56% from $64.0 million in the fourth quarter of 2006. Catastrophe losses, net of reinsurance and tax, during the quarter were $22.2 million compared with no catastrophes losses in the fourth quarter of 2006. Results for the quarter benefited by $5.9 million after-tax from a client commission reconciliation project, which has been completed. Net operating income in 2007 increased 57% to $379.2 million compared to $241.1 million in 2006. Net operating income increases were largely driven by the continued growth in creditor-placed homeowners insurance, continued favorable combined ratios and an increase in investment income. For the year, catastrophe losses, net of reinsurance and tax, were $22.2 million, compared with $4.5 million in 2006.

Assurant Specialty Property fourth quarter 2007 net earned premiums increased 36% to $476.4 million compared to $350.9 million in the fourth quarter of 2006. Net earned premiums in 2007 increased 39% to $1.68 billion compared to $1.21 billion in 2006. These increases are primarily due to the continued growth in creditor-placed homeowners insurance. The results for the year also benefited from the creditor-placed business acquired from Safeco in May of 2006.

Assurant Health

Assurant Health fourth quarter 2007 net operating income increased 3% to $38.0 million from $37.0 million in the fourth quarter of 2006. The increase is primarily due to a favorable combined ratio and $2.5 million after-tax from a favorable legal settlement. Net operating income for 2007 decreased 10% to $151.7 million from $167.9 million in 2006. The decrease for the year is primarily due to the decline in small group net earned premiums, a slight increase in the combined ratio due to higher small group loss experience and a decrease in investment income. This was partially offset by continued favorable individual medical loss experience and individual medical net earned premium growth. After-tax investment income from real estate joint venture partnerships was $2.5 million lower in 2007 compared to 2006.

Assurant Health fourth quarter 2007 net earned premiums decreased 2% to $509.3 million from $519.4 million in the fourth quarter of 2006. Net earned premiums for the year decreased 2% to $2.05 billion from $2.08 billion in 2006. Although individual medical premiums increased for the quarter and the full year of 2007, small group premiums continued to decline consistent with expectations.

Assurant Employee Benefits

Assurant Employee Benefits fourth quarter 2007 net operating income decreased 17% to $16.2 million from net operating income of $19.4 million in the fourth quarter of 2006. Results declined primarily due to a slight increase in loss experience due to a $2.1 million after-tax adjustment to reflect New York State's clarification of certain disability contract provisions and a decline in investment income. Net operating income in 2007 increased 4% to $87.0 million from $83.6 million during 2007. Full year results benefited from continued favorable overall loss experience, particularly in group disability, and were positively impacted by an additional $9.2 million of after-tax investment income from real estate joint venture partnerships compared to 2006.

Assurant Employee Benefits fourth quarter 2007 net earned premiums increased 4% to $291.6 million from $280.0 million in the same year-ago period. The increase is mainly the result of $14.3 million of single premium from a closed block of business. Net earned premiums for 2007 decreased 3% to $1.14 billion from $1.18 billion in 2006 as the company continued to implement its small case strategy.

Corporate & Other

Corporate and other net operating loss for the fourth quarter of 2007 was $27.4 million, compared to a loss of $19.9 million in the fourth quarter of 2006. Higher losses are mainly due to $4.3 million of after-tax expense during the quarter related to the ongoing SEC investigation regarding certain loss mitigation products. The fourth quarter 2007 results include $6.4 million of net tax expense associated with changes in certain tax liabilities compared with $6.2 million of similar net tax expense in the fourth quarter of 2006. Corporate and other net operating loss for 2007 was $49.4 million compared to a loss of $32.8 million during 2006. The higher loss for the year was primarily due to $7.5 million of after-tax expense related to the ongoing SEC investigation regarding certain loss mitigation products and $9.9 million of net tax expense associated with changes in certain tax liabilities compared with $6.2 million of similar net tax expense in 2006.

Financial Position

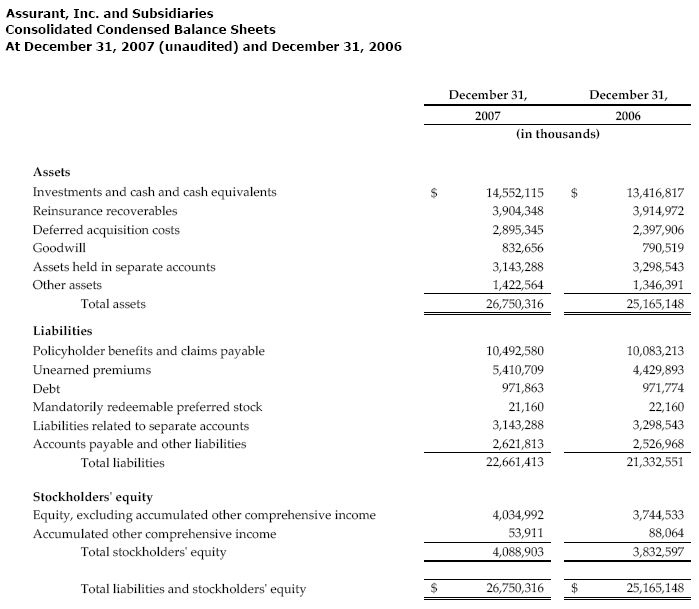

At December 31, 2007 total assets were $26.8 billion. Stockholders' equity, excluding Accumulated Other Comprehensive Income (AOCI), was $4.0 billion and book value per diluted share, excluding AOCI, was up 13% to $33.73 from $29.97 at December 31, 2006. 2007 operating return on equity (ROE), excluding AOCI, (see footnote 2), was 17.8%. The debt to total capital ratio, excluding AOCI, was 19.7%.

Earnings Conference Call

Assurant will host a conference call today at 9:00 A.M. (ET) with access available via Internet and telephone. Investors and analysts may participate in the live conference call by dialing 888-603-6873 (toll-free domestic) or 973-582-2706 (international); passcode: 29714389. Please call to register at least 10 minutes before the conference call begins. A replay of the call will be available for one week via telephone starting at approximately 12:00 P.M. (ET) today and can be accessed at 800-642-1687 (toll-free domestic) or 706-645-9291 (international); passcode: 29714389. The webcast will be archived for one month on Assurant's website.

About Assurant

Assurant is a premier provider of specialized insurance products and related services in North America and selected other international markets. The four key businesses -- Assurant Solutions; Assurant Specialty Property; Assurant Health; and Assurant Employee Benefits -- have partnered with clients who are leaders in their industries and have built leadership positions in a number of specialty insurance market segments in the U.S. and selected international markets. The Assurant business units provide debt protection administration; credit-related insurance; warranties and service contracts; pre-funded funeral insurance; creditor-placed homeowners insurance; manufactured housing homeowners insurance; individual health and small employer group health insurance; group dental insurance; group disability insurance; and group life insurance.

Assurant, a Fortune 500 company and a member of the S&P 500, is traded on the New York Stock Exchange under the symbol AIZ. Assurant has more than $25 billion in assets and $7 billion in annual revenue. Assurant has more than 13,000 employees worldwide and is headquartered in New York's financial district. www.assurant.com.

Safe Harbor Statement

Some of the statements included in this press release, particularly those anticipating future financial performance, business prospects, growth and operating strategies and similar matters, are forward-looking statements that involve a number of risks and uncertainties. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. For a discussion of the factors that could affect our actual results please refer to the risk factors identified from time to time in our SEC reports, including, but not limited to, our 10-K, as filed with the SEC.

Non-GAAP Financial Measures

Assurant uses the following non-GAAP financial measures to analyze the company's operating performance for the periods presented in this press release. Because Assurant's calculation of these measures may differ from similar measures used by other companies, investors should be careful when comparing Assurant's non-GAAP financial measures to those of other companies.

(1) Assurant uses net operating income as an important measure of the company's operating performance. As shown in the chart on page 3, net operating income equals net income excluding net realized gains (losses) on investments and other unusual and/or infrequent items. The company believes net operating income provides investors a valuable measure of the performance of the company's ongoing business, because it excludes both the effect of realized gains (losses) on investments that tend to be highly variable from period to period, and those events that are unusual and/or unlikely to recur.

(2) Assurant uses both annualized operating ROE and rolling four quarter operating ROE as important measures of the company's operating performance. Annualized operating ROE equals year to date net operating income divided by average stockholders' equity for the year to date period, excluding AOCI, and then the yield is annualized. Rolling four quarter operating ROE equals net operating income of the previous four quarters divided by average stockholders' equity for the four quarter period, excluding AOCI. The company believes annualized operating ROE and rolling four quarter operating ROE provide investors valuable measures of the performance of the company's ongoing business, because they exclude the effect of realized gains (losses) on investments that tend to be highly variable and those events that are unusual and/or unlikely to recur. Also, rolling four quarter operating ROE diminishes the effect of seasonality which can be highly variable within our business, particularly within Assurant Specialty Property. The comparable GAAP measure for these included measures would be annualized return on equity, defined as the annualized yield of year to date net income divided by average stockholders' equity for the year to date period, which was 16.8% for the year ended December 31, 2007.

Please see page 17 of the financial supplement, which is available on our website at www.assurant.com, for a summary of net operating income disclosed items.

Press Contact:

Drew Guthrie

Manager, Communications

and Media Relations

Phone: 212-859-7002

Fax: 212-859-5893

[email protected]

Investor Relations:

Melissa Kivett

Senior Vice President

Investor Relations

Phone: 212-859-7029

Fax: 212-859-5893

[email protected]

John Egan

Vice President

Investor Relations

Phone: 212-859-7197

Fax: 212-859-5893

[email protected]