NEW YORK, June 15, 2006—Assurant, Inc. ("Assurant") (NYSE: AIZ), a premier provider of specialized insurance and insurance-related products and services, today announced that it has purchased its property catastrophic ("CAT") reinsurance program effective June 1, 2006.

Assurant utilizes catastrophe reinsurance for its Assurant Specialty Property business to protect the company쳌fs capital base from catastrophe risk and lessen the inherent variability catastrophes can have on earnings.

In structuring the property catastrophe reinsurance program, the company applies a disciplined risk management process including utilizing multiple catastrophic models to evaluate the estimated loss potential from various perils, analyzing the geographic spread of risk and quantifying the reinsurance cost relative to the coverage provided, as well as the credit quality, financial strength and claims paying ability of the reinsurers.

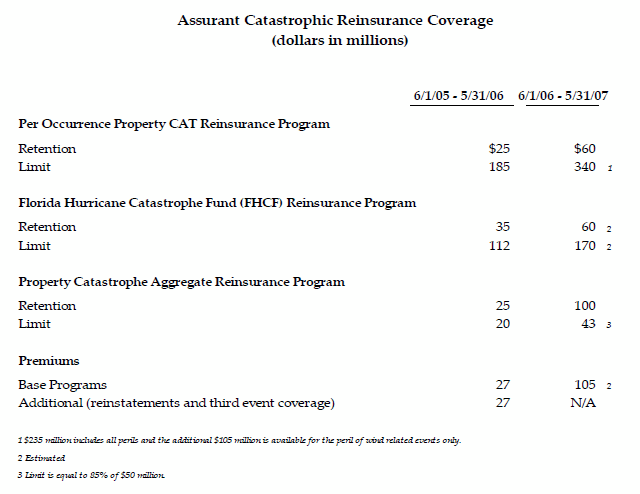

Effective June 1, 2006 for the term of one year, Assurant has placed one hundred percent of its per occurrence property CAT reinsurance program with over thirty highly rated reinsurers. Assurant has purchased coverage with a $340 million limit in excess of a $60 million retention, which provides coverage for a $400 million event. The program includes an automatic reinstatement for a second event under terms similar to the first event.

In addition to the per occurrence property CAT reinsurance program, the Florida Hurricane Catastrophe Fund ("FHCF") provides Florida specific coverage of approximately $170 million for the 2006 hurricane season with an estimated retention of $60 million. For Florida hurricanes, the FHCF program will be utilized first before Assurant쳌fs per occurrence property CAT reinsurance program.

The company has also placed 85% of $50 million in aggregate coverage in excess of $100 million of losses. This provides protection for multiple events. Events of at least $10 million in losses are eligible for inclusion and no one event can contribute more than $50 million to the $100 million retention. A comparison of the reinsurance retentions, limit and premiums for the prior and current programs is outlined below:

The increases in the retention and limit from our three reinsurance programs are attributable the significant growth in net written premium of Assurant Specialty Property including the Safeco FIS acquisition (estimated at $140 million of annual net written premium) and changes in catastrophic risk models used to estimate potential catastrophe loss levels.

The increase in catastrophic reinsurance premium is driven by the increase in the amount of reinsurance coverage purchased, general reinsurance marketplace conditions, and the changes in risk models that have increased estimated potential catastrophic loss levels. Base pretax 2006 reinsurance premiums, which are a reduction to net earned premiums are estimated to be $12 million in the second quarter and $26 million per quarter in the third and fourth quarter of 2006. Base reinsurance premiums could vary if net written premiums vary significantly from estimates. It is important to note that the expected reinsurance premiums included in the above chart do not include reinstatement premiums which may be contractually required as a result of the actual frequency and severity of the 2006 catastrophic reinsurance covered events.

About Assurant

Assurant is a premier provider of specialized insurance products and related services in North America and selected other international markets. The four key businesses -- Assurant Employee Benefits; Assurant Health; Assurant Solutions; and Assurant Specialty Property -- have partnered with clients who are leaders in their industries and have built leadership positions in a number of specialty insurance market segments in the U.S. and selected international markets. The Assurant business units provide creditor-placed homeowners insurance; manufactured housing homeowners insurance; debt protection administration; credit-related insurance; warranties and extended service contracts; individual health and small employer group health insurance; group dental insurance; group disability insurance; group life insurance; and pre-funded funeral insurance.

The company, which is traded on the New York Stock Exchange under the symbol AIZ, has over $20 billion in assets and $7 billion in annual revenue. Assurant has more than 12,000 employees worldwide and is headquartered in New York.s financial district. www.assurant.com

Safe Harbor Statement

Some of the statements included in this press release, particularly those anticipating future financial performance, business prospects, growth and operating strategies and similar matters, are forward-looking statements that involve a number of risks and uncertainties. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. For a discussion of the factors that could affect our actual results please refer to the risk factors identified from time to time in our SEC reports, including, but not limited to, our 10-K, as filed with the SEC.

Press Contact:

Drew Guthrie

Manager, Communications

and Media Relations

Phone: 212-859-7002

Fax: 212-859-5893

[email protected]

Investor Relations:

Melissa Kivett

Vice President

Investor Relations

Phone: 212-859-7029

Fax: 212-859-5893

[email protected]

Larry Cains

Senior Vice President

Investor Relations

Phone: 212-859-7045

Fax: 212-859-5893

[email protected]