NEW YORK, August 3, 2006—Assurant, Inc. ("Assurant") (NYSE: AIZ), a premier provider of specialized insurance and insurance-related products and services, today reported its results for the second quarter 2006 and the six months ended June 30, 2006.

Second Quarter Results

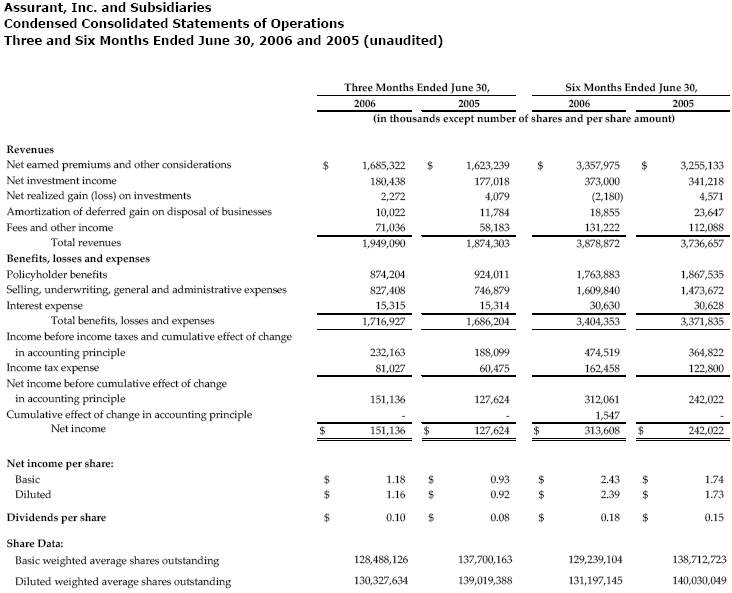

Net income in the second quarter of 2006 was $151.1 million, or $1.16 per diluted share, versus second quarter 2005 net income of $127.6 million, or $0.92 per diluted share.

Net operating income (see footnote 1 at the end of this release) for the second quarter of 2006 increased 15% to $149.7 million, or $1.15 per diluted share, compared to second quarter 2005 net operating income of $130.2 million, or $0.94 per diluted share. Net operating income excludes capital gains and losses and other unusual, or non-recurring, items.

Robert B. Pollock, Assurant's president and chief executive officer, said: "We are pleased with the continued strong quarterly results of our diverse and specialized insurance business, especially with the growth and profitability we are achieving in our Specialty Property business."

Net earned premiums of $1.7 billion in the second quarter of 2006 increased 4% from $1.6 billion in the same period in 2005.

Net investment income in the second quarter of 2006 increased to $180.4 million from $177.0 million in the second quarter of 2005 as a result of higher invested assets and a rise in interest rates. The second quarter of 2005 included $9.4 million of investment income from a real estate partnership. The yield on average invested assets and cash and cash equivalents, which excludes real estate investment income, was 5.83% in the second quarter of 2006, compared to 5.63% in the second quarter of 2005.

Six-Month Results

Net income in the first half of 2006 was $313.6 million, an increase of 30%, or $2.39 per diluted share, versus first half 2005 net income of $242 million, or $1.73 per diluted share.

Net operating income for the first half of 2006 increased 28% to $313.5 million, or $2.39 per diluted share, compared to first half 2005 net operating income of $245.3 million, or $1.75 per diluted share. Net operating income excludes capital gains and losses and other unusual, or non-recurring, items.

Net earned premiums of $3.4 billion in the first half of 2006 increased 3% from $3.3 billion in the same period in 2005.

Net investment income in the first half of 2006 increased to $373.0 million from $341.2 million in the first half of 2005 as a result of higher invested assets and a rise in interest rates. Investment income includes $14.7 million of investment income from a real estate partnership in the first half of 2006 and $9.4 million in the first half of 2005. The yield on average invested assets and cash and cash equivalents, which excludes real estate investment income, was 5.74% in the first half of 2006 compared to 5.57% in the first half of 2005.

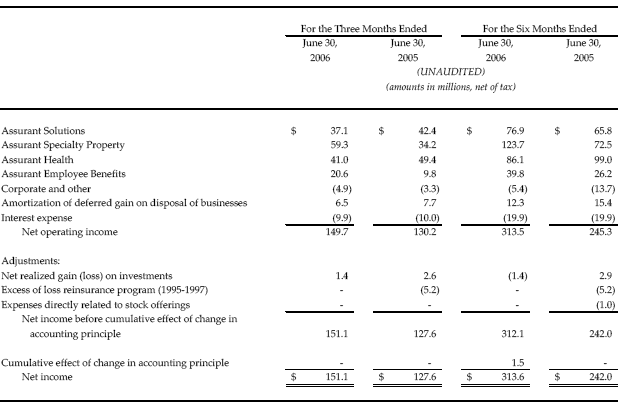

The following chart provides a reconciliation of net operating income to net income for Assurant, including separate net operating income for Assurant Solutions (which now includes the preneed business) and Assurant Specialty Property.

Assurant Solutions

Assurant Solutions second quarter 2006 net operating income was $37.1 million, a decrease of 12% from second quarter 2005 net operating income of $42.4 million. Second quarter 2005 results included $9.4 million pre-tax investment income from a real estate partnership. Net operating income for the first half of 2006 was $76.9 million, an increase of 17%, from $65.8 million during the first half of 2005. Net operating income during the second quarter and first half of 2006 was positively impacted by higher investment income and fee income driven primarily by growth in domestic and international extended service contracts.

Assurant Solutions second quarter 2006 net earned premiums increased 7% to $592.2 million from $554.8 million in the same year-ago period. Net earned premiums during the first half of 2006 increased 7% to $1.2 billion from $1.1 billion during the first half of 2005. The increases are attributable primarily to the steady growth in domestic and international extended service contracts partially offset by the anticipated decline in preneed premiums due to the sale of the U.S. independent preneed franchise.

Assurant Specialty Property

Assurant Specialty Property second quarter 2006 net operating income was $59.3 million, an increase of 73% from second quarter 2005 net operating income of $34.2 million. Net operating income for the first half of 2006 grew 71% to $123.7 million compared to $72.5 million during the first half of 2005. Net operating income increases in the second quarter and first half are primarily the result of premium growth, continued favorable combined ratios and a positive contribution from the acquisition of Safeco Financial Institution Solutions (Safeco FIS). In addition, results were favorably impacted by increased investment income and by reimbursements received for processing claims under the National Flood Insurance Program. These reimbursements totaled $1.9 million pre-tax in the second quarter and $9.7 million pre-tax in the first half of 2006.

Assurant Specialty Property second quarter net earned premiums increased by 40%, to $291.0 million, compared to $207.7 million in the same period a year ago. Net earned premiums during the first half of 2006 increased 33% to $543.7 million compared to $408.8 million during the first half of 2005. The increase is primarily attributable to growth in net earned premiums in the creditor-placed homeowners business including $30 million of net earned premiums representing two months of assumed business from Safeco FIS.

Assurant Health

Assurant Health second quarter 2006 net operating income decreased 17% to $41.0 million from $49.4 million in the same period in 2005. Net operating income for the first half of 2006 decreased 13% to $86.1 million from $99.0 million during the first half of 2005. The decreases in net operating income are primarily due to declines in net earned premiums in small group. Assurant Health has continued to maintain a low combined ratio despite an increase in expenses to grow the individual medical business.

Assurant Health second quarter 2006 net earned premiums of $519.6 million decreased 5% from $544.3 million in the same period in 2005. Net earned premiums for the first half of 2006 decreased 5% to $1.0 billion compared to $1.1 billion in the first half of 2005. Growth in individual medical net earned premiums was offset by declines in small group premiums.

Assurant Employee Benefits

Assurant Employee Benefits second quarter 2006 net operating income increased 110% to $20.6 million from net operating income of $9.8 million in the same period of 2005. Net operating income for the first half of 2006 increased 52% to $39.8 million from $26.2 million during the first half of 2005. The increases are primarily due to favorable disability, life and dental loss experience.

Assurant Employee Benefits second quarter 2006 net earned premiums decreased 11% to $282.6 million from $316.4 million in the same period of 2005. Net earned premiums for the first half of 2006 decreased 8% to $608.7 million from $662.3 million in the first half of 2005. The decrease was driven primarily by lower sales and persistency due to our small case focus and our continued underwriting discipline.

Corporate

Corporate and other net operating loss for the second quarter of 2006 was $4.9 million, compared to a loss of $3.3 million in the second quarter of 2005. The second quarter of 2005 included a tax benefit of $5.2 million related to a tax clarification for taxes on repatriated capital under the American Jobs Creation Act. Corporate and other net operating loss for the first half totaled $5.4 million compared to a loss of $13.7 million in the first half of 2005. The improvement in the first half of 2006 results is primarily due to a reduction in expenses associated with the change in accounting methodology for stock appreciation rights costs. Amortization of deferred gains from businesses sold through reinsurance declined consistent with the anticipated run-off of these businesses.

Financial Position

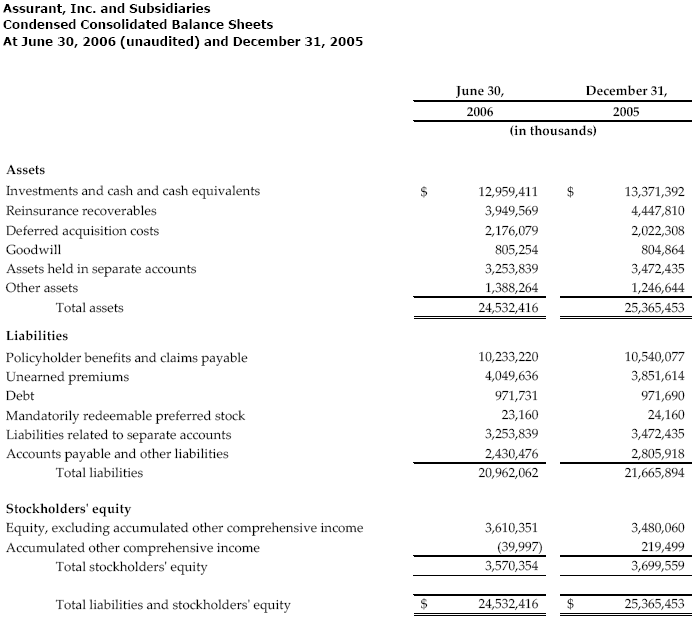

June 30, 2006 total assets were $24.5 billion. Stockholders' equity, excluding Accumulated Other Comprehensive Income (AOCI,) was $3.6 billion and book value per diluted share, excluding AOCI, was up 6% to $27.95 from $26.25 at December 31, 2005. AOCI, which mainly consists of unrealized gains and losses on our fixed income securities, declined by $259.5 million after-tax mainly due to the impact of rising interest rates during the quarter. Debt to total capital, excluding AOCI, dropped to 21.6%.

Earnings Conference Call

Assurant will host a conference call Thursday, August 3, 2006 at 9:00 A.M. (ET) with access available via Internet and telephone. Investors and analysts may participate in the live conference call by dialing 800-473-6123 (toll-free domestic) or 973-582-2706 (international); passcode: 7216424. Please call to register at least 10 minutes before the conference call begins. A replay of the call will be available for one week via the telephone starting at approximately 12:00 P.M. (ET) on August 3, 2006 and can be accessed at 877-519-4471 (toll-free domestic) or 973-341-3080 (international); passcode: 7216424. The webcast will be archived for one month on Assurant's website.

About Assurant

Assurant is a premier provider of specialized insurance products and related services in North America and selected other international markets. The four key businesses -- Assurant Solutions; Assurant Specialty Property; Assurant Health; and Assurant Employee Benefits -- have partnered with clients who are leaders in their industries and have built leadership positions in a number of specialty insurance market segments in the U.S. and selected international markets. The Assurant business units provide creditor-placed homeowners insurance; manufactured housing homeowners insurance; debt protection administration; credit-related insurance; warranties and extended service contracts; individual health and small employer group health insurance; group dental insurance; group disability insurance; group life insurance; and pre-funded funeral insurance.

The company, which is traded on the New York Stock Exchange under the symbol AIZ, has over $20 billion in assets and $7 billion in annual revenue. Assurant has more than 12,000 employees worldwide and is headquartered in New York's financial district. www.assurant.com

Safe Harbor Statement Some of the statements included in this press release, particularly those anticipating future financial performance, business prospects, growth and operating strategies and similar matters, are forward-looking statements that involve a number of risks and uncertainties. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. For a discussion of the factors that could affect our actual results please refer to the risk factors identified from time to time in our SEC reports, including, but not limited to, our 10-K, as filed with the SEC.

Non-GAAP Financial Measures

Assurant uses the following non-GAAP financial measures to analyze the company's operating performance for the periods presented in this press release. Because Assurant's calculation of these measures may differ from similar measures used by other companies, investors should be careful when comparing Assurant's non-GAAP financial measures to those of other companies.

(1) Assurant uses net operating income as an important measure of the company's operating performance. Net operating income equals net income excluding net realized gains (losses) on investments and other unusual and/or infrequent items. The company believes net operating income provides investors a valuable measure of the performance of the company's ongoing business, because it excludes both the effect of realized gains (losses) on investments that tend to be highly variable from period to period, and those events that are unusual and/or unlikely to recur.

Press Contact:

Drew Guthrie

Manager, Communications

and Media Relations

Phone: 212-859-7002

Fax: 212-859-5893

[email protected]

Investor Relations:

Melissa Kivett

Senior Vice President

Investor Relations

Phone: 212-859-7029

Fax: 212-859-5893

[email protected]