NEW YORK, August 4, 2005—Assurant, Inc. ("Assurant") (NYSE: AIZ), a premier provider of specialized insurance and insurance-related products and services, today reported its results for the second quarter 2005 and the six-month period ended June 30, 2005.

J. Kerry Clayton, Chief Executive Officer, said: "We are very pleased with our second quarter performance driven by strong growth in net operating income. We continue to deliver shareholder value through our diversified specialty insurance strategy.

In addition to these excellent financial results, highlights of the quarter included strengthening our management team and separating our Assurant Specialty Property and Assurant Solutions businesses to better position them for future profitable growth."

Second Quarter Results

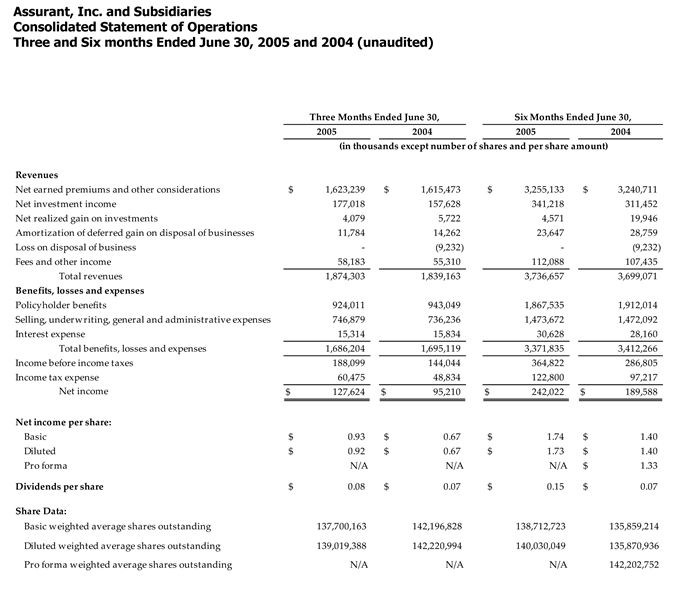

Net income in the second quarter of 2005 was $127.6 million, or $0.92 per diluted share, versus a second quarter 2004 net income of $95.2 million, or $0.67 per diluted share.

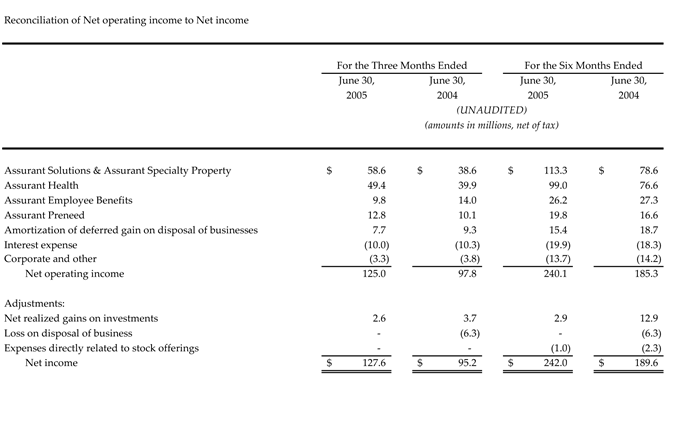

Net operating income (see footnote 2 at the end of this release) for the second quarter of 2005 increased 28% to $125.0 million, or $0.90 per diluted share, compared to second quarter 2004 net operating income of $97.8 million, or $0.69 per diluted share. Net operating income excludes investment gains or losses and other unusual items.

Net earned premiums of $1.6 billion in the second quarter of 2005 are unchanged from the same period in 2004.

Net investment income in the second quarter of 2005 increased to $177.0 million from $157.6 million in the second quarter of 2004 primarily as a result of an increase in average invested assets. The second quarter of 2005 includes $9.4 million of investment income realized from a real estate partnership. Excluding this item, the yield on average invested assets and cash and cash equivalents was 5.63% in the second quarter of 2005, compared to 5.57% in the second quarter of 2004.

Six-Month Results

Net income in the first half of 2005 was $242.0 million, or $1.73 per diluted share, versus first half 2004 net income of $189.6 million, or $1.33 per pro forma share (see footnote 1 at the end of this release).

Net operating income for the first half of 2005 increased 30% to $240.1 million, or $1.71 per diluted share, compared to net operating income of $185.3 million, or $1.30 per pro forma share. Net operating income excludes investment gains or losses and other unusual items.

Net earned premiums of $ 3.3 billion in the first half 2005 are unchanged from the same period in 2004.

Net investment income in the first half 2005 increased to $ 341.2 million from $311.5 million in the first half of 2004 primarily as a result of an increase in average invested assets. Excluding the $9.4 million real estate item, the yield on average invested assets and cash and cash equivalents was 5.57% in the first half of 2005, compared to 5.48% in the first half of 2004.

Assurant Solutions and Assurant Specialty Property

Assurant Solutions and Assurant Specialty Property second quarter 2005 net operating income was $58.6 million, up 52% from second quarter 2004 net operating income of $38.6 million. Net operating income for the first half of 2005 grew 44% to $113.3 million from $78.6 million in the first half of 2004. The net operating income increases are due to continued favorable loss experience in Assurant Specialty Property business, as well as growth in investment income and fee income from Assurant Solutions.

Assurant Solutions and Assurant Specialty Property second quarter 2005 net earned premiums increased 4% to $636.7 million from $610.6 million in the same year-ago period. Net earned premiums in the first half of 2005 increased 1% to $1.25 billion from $1.23 billion in the first half of 2004. The increases are a result of growth in the specialty property and extended service contract businesses. Domestic credit insurance premiums continued to decline, offset by strong international growth. Gross written premiums grew for all products, except domestic credit insurance.

Assurant Health

Assurant Health second quarter 2005 net operating income increased 24% to $49.4 million from $39.9 million in the same period in 2004. Net operating income for the first half of 2005 grew 29% to $99.0 million from $76.6 million in the first half of 2004. The increases in net operating income were driven by low medical loss ratios resulting in an 89.5% combined ratio for the quarter.

Assurant Health second quarter 2005 net earned premiums of $544.3 million were down 3% from the same period in 2004. Net earned premiums in the first half of 2005 decreased 1% to $1.09 billion from $1.11 billion in the first half of 2004. Premium increases in the individual medical business which resulted from higher premiums per member were offset by membership declines in the small group business.

Assurant Employee Benefits

Assurant Employee Benefits second quarter 2005 net operating income decreased 30% to $9.8 million from net operating income of $14.0 million in the same period of 2004. Net operating income for the first half of 2005 decreased 4% to $26.2 million from $27.3 million in the first half of 2004. Net operating income for the second quarter 2005 decreased primarily due to unfavorable disability experience, as a result of a decrease in claim closures caused largely by fewer deaths among disabled insureds.

Assurant Employee Benefits second quarter 2005 net earned premiums grew 2% to $316.4 million from $309.2 million in the same period of 2004. Net earned premiums in the first half of 2005 increased 6% to $662.3 million from $627.2 million in the first half of 2004. Net earned premium increases were primarily driven by higher disability premiums, including single premiums of $26.7 million in the first half of 2005 compared to $13.1 million in the same period of 2004 related to the assumption of closed blocks of disability claims.

Assurant Preneed

Assurant Preneed second quarter 2005 net operating income increased 27% to $12.8 million from net operating income of $10.1 million in the same period of 2004. Net operating income for the first half of 2005 grew 19% to $19.8 million from $16.6 million in the first half of 2004. The increase in net operating income for the second quarter 2005 includes a $6.1 million (after tax) of investment income realized from a real estate partnership. Excluding this item, income would have been lower in the first half of 2005 due to the continued low interest rate environment.

Assurant Preneed second quarter 2005 net earned premiums decreased 8% to $125.8 million from $136.3 million in the same period of 2004. Net earned premiums in the first half of 2005 decreased 8% to $247.0 million from $269.5 million in the first half of 2004. Declines were due to lower sales resulting from continued pricing discipline in a low interest rate environment.

Corporate

Amortization of deferred gains from businesses sold through reinsurance declined consistent with the anticipated run-off of these businesses. Corporate and other net operating loss for the second quarter of 2005 was $3.3 million, compared to a loss of $3.8 million in the second quarter of 2004. The second quarter and six months of 2005 included a tax benefit of $5.2 million related to a tax clarification for taxes on repatriated capital under the American Jobs Creation Act. Expenses include stock-appreciation-rights costs and public company costs, including expenses related to Sarbanes-Oxley 404 compliance.

Financial Position

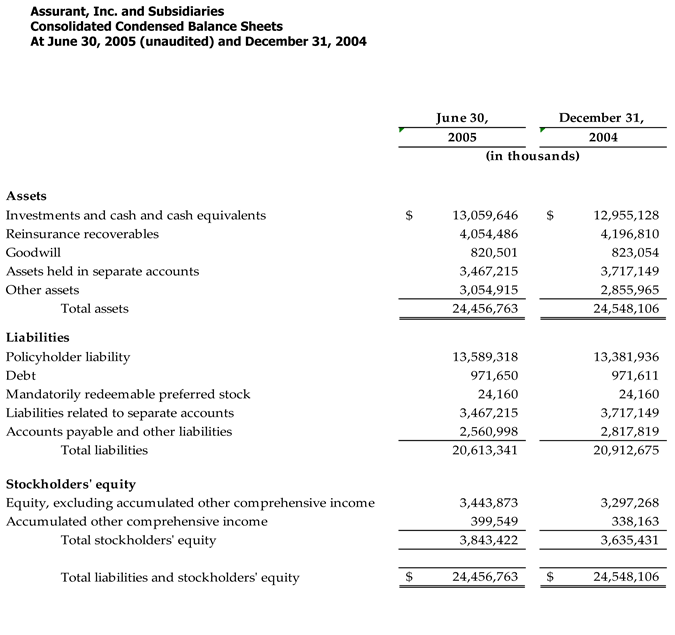

June 30, 2005 total assets were $24.5 billion. In the second quarter of 2005, Assurant had after-tax net capital gains of approximately $2.6 million compared to net realized after-tax gains of $3.7 million in the second quarter of 2004.

Earnings Conference Call

Assurant will host a conference call on Thursday, August 4th at 10:00 A.M. (ET) with access available via Internet and telephone. Investors and analysts may participate in the live conference call by dialing 800-473-6123 (toll-free domestic) or 973-582-2706 (international); passcode: 6225188. Please call to register at least 10 minutes before the conference call begins. A replay of the call will be available for one week via the telephone starting at approximately 12:00 P.M. (ET) on August 4, 2005 and can be accessed at 877-519-4471 (toll-free domestic) or 973-341-3080 (international); passcode: 6225188. The webcast will be archived for one month on Assurant's website.

About Assurant

Assurant is a premier provider of specialized insurance products and related services in North America and selected other international markets. The five key businesses-- Assurant Employee Benefits; Assurant Health; Assurant Preneed; Assurant Solutions and Assurant Specialty Property-- have partnered with clients who are leaders in their industries and have built leadership positions in a number of specialty insurance market segments in the U.S. and selected international markets. The Assurant business segments provide creditor-placed homeowners insurance; manufactured housing homeowners insurance; debt protection administration; credit-related insurance; warranties and extended service contracts; individual health and small employer group health insurance; group dental insurance; group disability insurance; group life insurance; and pre-funded funeral insurance.

The company, which is traded on the New York Stock Exchange under the symbol AIZ, has over $20 billion in assets and $7 billion in annual revenue. Assurant has more than 12,000 employees worldwide and is headquartered in New York's financial district. www.assurant.com

Safe Harbor Statement

Some of the statements included in this press release, particularly those anticipating future financial performance, business prospects, growth and operating strategies and similar matters, are forward-looking statements that involve a number of risks and uncertainties. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. For a discussion of the factors that could affect our actual results please refer to the risk factors identified from time to time in our SEC reports, including, but not limited to, our 10-K, as filed with the SEC.

Non-GAAP Financial Measures

Assurant uses the following non-GAAP financial measures to analyze the company's operating performance for the periods presented in this press release. Because Assurant's calculation of these measures may differ from similar measures used by other companies, investors should be careful when comparing Assurant's non-GAAP financial measures to those of other companies.

(1) Pro forma earnings per share have been included as a measure of 2004 operating performance. In February 2004, Assurant completed a significant capital restructuring in conjunction with its initial public offering of common stock. Pro forma earnings per share reflects earnings per share adjusted as if this capital restructuring had occurred on January 1, 2003. This restructuring included: a stock split and conversion of Class B and C shares resulting in total outstanding shares of 109,222,276; the issuance of 32,976,854 shares of Assurant common stock to Fortis Insurance N.V. in exchange for a capital contribution of $725.5 million, and the issuance of 68,976 restricted shares of Assurant common stock to certain officers and directors of the company pursuant to specific restricted stock grants These transactions occurred subsequent to the December 31, 2003 balance sheet, but management believes that this adjusted measure provides a better indication of operating performance than the corresponding GAAP measure, earnings per share. In 2005, earnings per share are based on actual average shares outstanding.

(2) Assurant uses net operating income as an important measure of the company's operating performance. Net operating income equals net income excluding net realized gains (losses) on investments and other unusual and/or infrequent items. The company believes net operating income provides investors a valuable measure of the performance of the company's ongoing business, because it excludes both the effect of realized gains (losses) on investments that tend to be highly variable from period to period, and those events that are unusual and/or unlikely to recur.

Press Contact:

Drew Guthrie

Manager, Communications

and Media Relations

Phone: 212-859-7002

Fax: 212-859-5893

[email protected]

Investor Relations:

Melissa Kivett

Vice President

Investor Relations

Phone: 212-859-7029

Fax: 212-859-5893

[email protected]

Larry Cains

Senior Vice President

Investor Relations

Phone: 212-859-7045

Fax: 212-859-5893

[email protected]