With a growing number of Americans choosing to rent versus buy, it can be a rewarding time to be in the property management business. But, like all roles, it’s not without challenges; modern renters are introducing new risks to your property that you may not have realized. Here are four things you need to know about the modern renter and mitigating risk to your property:

1. Modern renters invite the digital world in.

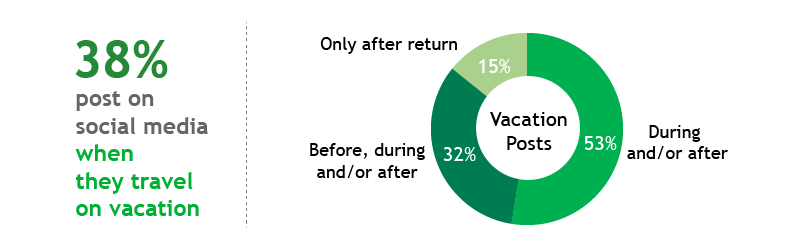

While it’s a good rule of thumb to avoid notifying the digital world that you’re out of town when you travel, a large portion of renters don’t follow that rule. According to our latest research study on the modern renter, nearly 40% of renters post their vacation status on social media, putting their valuables and your property at risk. To make matters worse, of the renters that share vacation updates with their followers, 85% post about the trip before it takes place or while they’re out of town when their homes are most vulnerable.

2. They don’t take extra precautions.

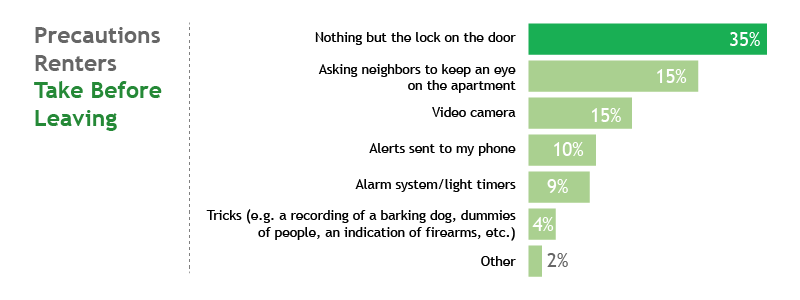

Locking the doors is the only precaution taken to avoid a break-in by 35% of renters. It’s rare for renters to use alarm systems, video cameras, or even to ask neighbors to keep an eye on their apartments. This is especially concerning because the value of renters’ possessions continues to rise.

3. They don’t voluntarily maintain a renter’s policy.

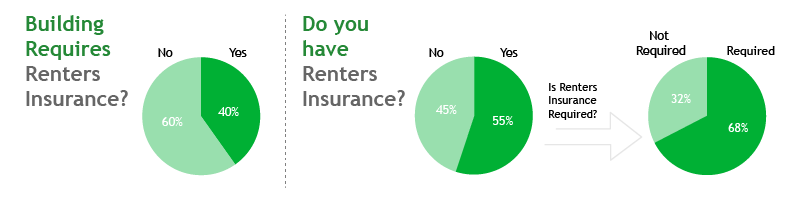

Around 45% of renters don’t have renter’s insurance, which may be attributed to confusion about who is responsible for property damages – the renter or property management company – when something goes wrong. A staggering 69% of renters either weren’t sure who was responsible for damages/liability or incorrectly identified the responsible party. This poses significant risk for PMCs who don’t make renter’s insurance a requirement, leaving them on the hook to collect damages from unprepared renters. By and large, renters are choosing not to carry a renter’s insurance policy unless it’s expressly required. In fact, 24% of renters say they’ve never even considered getting a policy, which indicates a need for renter education around property damage liability and the benefits of protection.

4. They have misperceptions about renter’s insurance when it comes to cost and responsibility for damages.

Cost is the top reason renters give for not having a policy, indicating that many renters believe renter’s insurance is more expensive than it is. The average annual cost of a policy is only around $160 a year – significantly less than the costs that would be incurred from paying out of pocket for other costs often associated with an incident, such as damage repair, hospital bills or replacing stolen goods. Following cost, the top reasons renters give for not having an insurance policy is not thinking about it or believing another party is responsible if anything goes wrong.